Cannabis Companies are Not Eligible for COVID-19 Government Bailout Programs like PPP, or are They?

Massroots becomes the first known cannabis company to receive government PPP bailout funds due to COVID-19

In a surprising turn in the saga of Isaac Dietrich and Massroots, the SBA, or Small Business Association, has given Massroots, a cannabis-technology platform, $50,000 in Payroll Protection Program money. While the government has said marijuana companies are not eligible for Federal COVID-19 funds, and has issued many warning online to businesses about fraud and misrepresentation of funds and expense, Massroots seems to have found a way to be a major cannabis brand and also receive government funds. The press release states:

MassRoots, Inc. ("MassRoots" or the "Company") (OTC Pink: MSRT), a technology platform for the regulated cannabis industry, announced it received a loan of $50,000 (the “PPP loan”) pursuant to the Paycheck Protection Program (“PPP”) of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) on May 3, 2020. The PPP loan matures in May 2022 and bears an interest rate of 1.0% per annum. Payments of principal and interest of any unforgiven balance commence in December 2020.

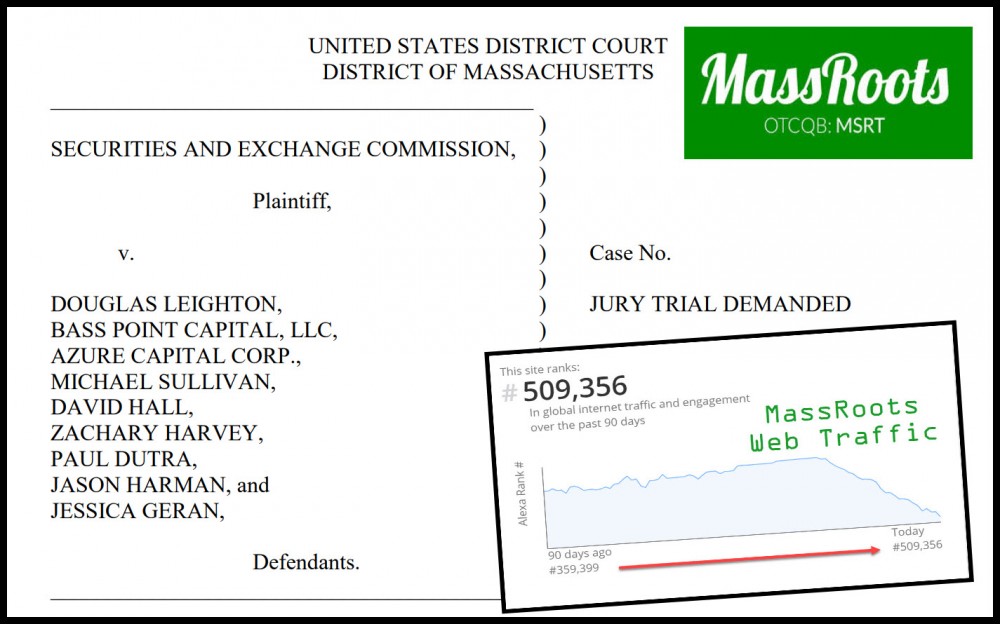

While the SEC just released their charges against the major shareholders of Massroots for stock manipulation claims, Isaac Dietrich, the CEO of Massroots, was conspicuously left off the indictments. While the SEC claimed to be assisted by an unnamed source in the papers, Isaac was not charged with anything at this point.

How did a marijuana company get Federal funds? The easiest way to would be apply as your incorporation name or apply as a tech company, and leave off the details that you are a cannabis centric company. If you apply as your incorporated name and not as your “d.b.a” (doing business as) you may escape the watchful eye of government check writers for a time.

Announcing the PPP loan as a press release may be a huge mistake, time will tell. If Massroots did circumvent the current understanding of the PPP loan and how they relate to cannabis companies, the press release may not have been a good idea, especially while the SEC charges were just released in the last few weeks.

Did Massroots open the door for other cannabis companies to access government bailout funds or did they just bring more unwanted attention to a company that already finds itself in the crosshairs of government regulators and the SEC? If this opens the door for marijuana companies to get access to funds from the CARES Act or the PPP pogram, it could be a game-changer for the industry.

Here is a link to their press release announcing $50,000 in PPP Funds:

https://www.businesswire.com/news/home/20200505005365/en/

Deb Borchardt of the Green Market Report does a great job of outlining the recent trials and tribulations of Massroots, including their recent $50,000 PPP loan and SEC investigation, read it here.

THE TRIALS OF MASSROOTS, READ MORE....

THE SEC COMES AFTER MASSROOTS AND ITS SHAREHOLDERS