Canada Is Going To Tax Edibles Based On THC – And You Might Be Getting Tasteless Edibles

The Liberal government of Canada has mandated a tax rate for edibles and topicals that will be based on its THC content, for the 2019 budget which will take effect May 1st.

The recommendations are endorsed by the country’s cannabis task force. “Budget 2019 proposes that edible cannabis, cannabis extracts (including cannabis oils) and cannabis topicals be subject to excise duties imposed on cannabis licensees at a flat rate applied on the quantity of total tetrahydrocannabinol (THC), the primary psychoactive compound in cannabis, contained in a final product,” states the budget.

In other words, the higher the THC content is of a product, the more taxes it will bear. This decision was made for easier compliance by manufacturers of cannabis oils, though the taxes will be applicable to both recreational and medicinal cannabis.

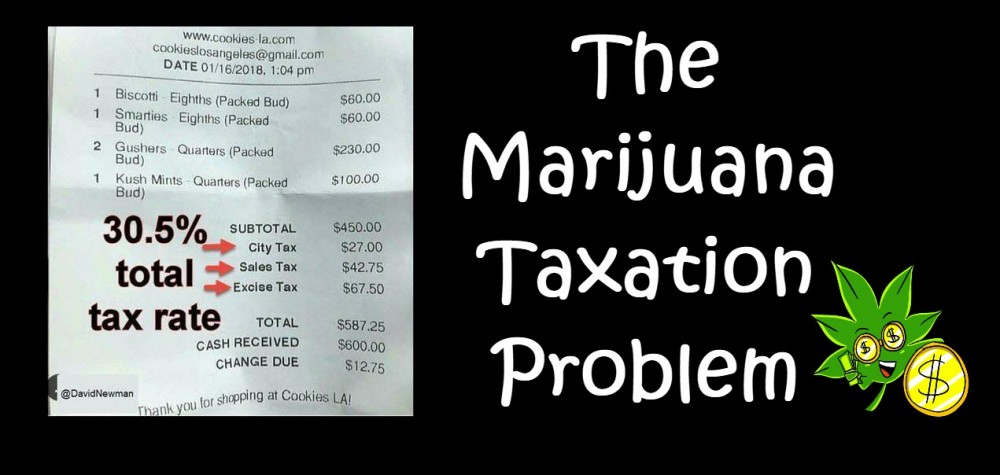

Currently, the excise tax for cannabis oils and dried cannabis flower, which were legalized last October 2018 for recreational use, is capped at 10% per gram or a gram-equivalent; translating to $1 a gram whichever is more.

However, products that contain cannabidiol (CBD), the other major constituent in the plant that doesn’t get you high, are exempt from the excise tax. For this reason, most producers are focusing their business plans on CBD products for the coming fall.

Not everyone is happy about this decision, clearly. Licensed producers maintain that cannabis products marketed to medical patients shouldn’t be subject to excise taxes.

It’s in the best interest of Canadian cannabis edibles and oils producers to consult their lawyers so as to avoid any legal issues later on. “Cannabis oils are treated slightly differently under the current regime, where the flat-rate tax is based on the amount of cannabis material used in the production process,” explains Whitney Abrams, associate at Toronto’s Minden Gross LLP. “Lawyers who are advising licensed producers or anyone looking to get into the cannabis edible, topical or extract market, once available, should be aware of these changes and know hwo to advise their clients accordingly on this aspect,” she tells Legal Feeds in an email.

Canadian Edibles Industry May Have Questionable Taste

Aside from potentially high taxes depending on its THC content, there are also concerns that when edibles hit shelves of Canada’s licensed retailers by fall, that they might not even taste good.

By October 17, 2019, edibles will finally be legal in Canada although infused-goods producers are facing serious obstacles. Even if the Canadian government has already given them the green light for making space cakes and other edibles, they aren’t able to let possible customers do a taste test. In order to do this, edible producers need to get a specific research license from the government prior to letting customers come in and do a taste test.

Experts say that the application for getting one license can take as long as four months, while many other companies are still waiting for feedback.

“People are certainly interested in doing tast testing, but the research licenses to do so haven’t been issued yet,” said Brenna Boonstra, Director of Quality and Regulatory at Cannabis Compliance Inc, to CTV News.

Though this doesn’t necessarily mean that all edibles to hit the shelves by October will taste disgusting. There are a handful of companies that have succeeded with getting people to sample their goods prior to launching.

“It’s a challenge. Everyone is running for the October deadline, and we’re trying to develop multiple products at the same time. The more certainty you have, the easier it is to innovate products,” said Jeff Zietlow of CannTrust Holdings Inc.

BDS Analytics estimates that the edibles market in the United States in Canada will be worth $1.4 billion by 2022, but Canada still needs to iron out many issues with regards to their supply as well as edibles regulations.

Until October, Canadians can legally make their own infused food and beverages at home but it’s still illegal for people to buy or sell them. Canadians also shouldn’t expect to get any potent edibles once available, because the proposed federal regulations will limit one serving of edibles to 10mg of THC.

OTHER STORIES YOU MAY ENJOY...

COULD CANNABIS TAXES GO TO 45%, CLICK HERE.

OR..

SHOULD TAX REVENUE GO TO TOWNS THAT BAN DISPENSARISE, CLICK HERE.