In recent months, Michigan has found itself at the intersection of two significant issues: the deteriorating state of its roads and the burgeoning cannabis industry. Governor Gretchen Whitmer’s ambitious plan to allocate funds from marijuana taxes to repair potholes has ignited a lively debate within both the political and cannabis communities. As the state grapples with aging infrastructure, the proposal raises questions about funding priorities, industry sustainability, and consumer impact. This article delves into the details of the plan, its implications for Michigan’s cannabis sector, and the broader conversation it has sparked.

The State of Michigan’s Roads

Michigan is notorious for its rough roads. According to a report from the American Society of Civil Engineers, nearly 40% of Michigan’s roads are in poor condition, leading to increased vehicle damage and safety concerns for drivers. The state has long struggled with funding for road repairs, often relying on gas taxes and federal funds that have proven insufficient to address the growing backlog of maintenance needs.

The Economic Impact of Poor Infrastructure

The economic ramifications of poor road conditions are profound. Businesses face higher transportation costs due to vehicle wear and tear, while residents experience longer commute times and reduced quality of life. Additionally, inadequate infrastructure can deter new businesses from setting up shop in Michigan, further stifling economic growth.

Governor Whitmer’s Proposal

In response to these pressing issues, Governor Whitmer announced a comprehensive $3 billion plan aimed at revitalizing Michigan’s roads. The proposal focuses on innovative funding strategies, including a significant increase in taxes on marijuana products.

Funding Breakdown

The proposed funding plan includes:

-

$1.7 billion from corporate taxes and technology companies.

-

$1.2 billion from increased gas taxes.

-

$500 million cut from unspecified spending areas.

-

A 32% wholesale tax on marijuana products projected to generate $470 million annually.

This ambitious approach aims not only to repair potholes but also to create a more sustainable funding model for ongoing infrastructure needs.

The Role of Cannabis Tax Revenue

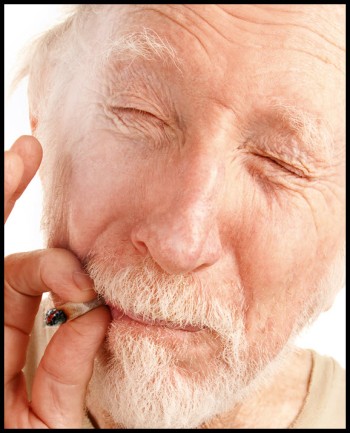

Michigan legalized recreational marijuana in 2018, leading to a rapid expansion of the cannabis market. With over 400 licensed dispensaries and a thriving cultivation sector, tax revenue from cannabis sales has become a significant source of income for the state. Currently, marijuana products are subject to a 10% excise tax and a 6% sales tax; however, Governor Whitmer’s proposal seeks to elevate this wholesale tax substantially.

Reactions from the Cannabis Community

The announcement has elicited mixed reactions from various stakeholders within Michigan’s cannabis community. While some applaud the idea of using cannabis tax revenue for public goods like road repairs, others express concern about the potential negative consequences for the industry.

Support for the Initiative

Many proponents argue that using cannabis tax revenue for infrastructure improvements is a logical step forward. They contend that as one of the most lucrative sectors in Michigan’s economy, the cannabis industry should contribute significantly to public services.

-

Public Good Argument: Advocates argue that better roads benefit everyone, including those in the cannabis industry who rely on transportation for distribution and customer access.

-

Community Investment: Some believe that investing in infrastructure will enhance overall community well-being and support local businesses.

Concerns About Increased Taxes

On the other hand, several dispensary owners and industry advocates express serious concerns about the proposed tax increase:

-

Impact on Consumers: Many fear that raising taxes on marijuana products will lead to higher prices for consumers. One dispensary owner noted that some products could see price increases close to 90%, making legal cannabis less competitive against black market alternatives.

-

Market Viability: There is apprehension that higher prices could drive consumers back into the black market, undermining years of progress made in legalizing and regulating cannabis sales.

-

Small Business Struggles: Smaller dispensaries may struggle more than larger corporations to absorb increased costs, potentially leading to business closures and reduced competition in the market.

Broader Economic Implications

The intersection of road funding and cannabis taxation raises broader questions about economic policy in Michigan. As states across the U.S. grapple with similar challenges—balancing public needs with industry growth—Michigan’s approach may serve as a case study for others.

Balancing Act: Public Needs vs. Industry Growth

Governments must find ways to fund essential services while fostering economic growth in emerging industries like cannabis. The challenge lies in ensuring that taxation does not stifle innovation or drive consumers away from legal markets.

Potential Alternatives

Some industry representatives have called for alternative funding solutions that do not rely solely on increased taxation:

-

Reallocation of Existing Funds: Advocates suggest examining current budget allocations to identify areas where funds can be redirected toward road repairs without imposing new taxes.

-

Public-Private Partnerships: Collaborations between government entities and private companies could provide innovative solutions for funding infrastructure projects without burdening taxpayers or industries.

-

Incentives for Local Businesses: Offering incentives or tax breaks for local businesses involved in road repair projects could stimulate job creation while addressing infrastructure needs.

Political Landscape

Governor Whitmer’s proposal has also ignited discussions within Michigan’s political landscape. Republican lawmakers have voiced opposition to increasing taxes on marijuana products as part of road funding strategies.

Republican Counterproposal

In response to Whitmer’s plan, Republican lawmakers have proposed an alternative $3 billion road funding strategy that does not rely on tax increases. This plan emphasizes reallocating existing funds rather than imposing new taxes on any industry.

Bipartisan Cooperation Challenges

While both parties agree on the need for better roads, finding common ground on how to fund these improvements remains elusive. The debate over using marijuana tax revenue highlights broader ideological differences regarding taxation and government spending priorities.

The Future of Cannabis Regulation in Michigan

As discussions around Governor Whitmer’s proposal continue, they underscore broader trends in cannabis regulation across the United States. States that have legalized marijuana are increasingly looking at how best to leverage tax revenue generated from this burgeoning industry.

Lessons Learned from Other States

States like Colorado and California have faced similar challenges regarding how best to utilize cannabis tax revenue. In Colorado, funds have been allocated toward education initiatives and public health programs; however, debates continue over how effectively these funds are being utilized.

Ensuring Transparency and Accountability

For Michigan’s approach to be successful, it will be essential to establish transparency and accountability measures regarding how cannabis tax revenues are spent. Ensuring that funds are directed toward meaningful infrastructure improvements will be critical in maintaining public support for both road repairs and continued investment in the cannabis industry.

Conclusion

Governor Gretchen Whitmer’s plan to fix potholes using marijuana tax revenue has sparked an important conversation about infrastructure funding and its relationship with emerging industries like cannabis. While many see this as an innovative solution to longstanding issues with road conditions in Michigan, others raise valid concerns about potential negative impacts on consumers and small businesses within the cannabis sector.

As discussions evolve, it will be crucial for stakeholders from government officials to industry representatives to engage collaboratively in seeking solutions that benefit both public infrastructure needs and economic growth within the cannabis community. The outcome of this debate may not only shape Michigan’s future but also serve as a model for other states navigating similar challenges as they balance public service needs with burgeoning industries’ growth potential.