MedMen Goes Public In Canada, Stock Immediately Drops 25% in 48 Hours

Another US cannabis company is going public up north.

Los Angeles company MedMen has just started listing on the Canadian Securities Exchange, and is now the latest US company to do so. They are going public via a reverse takeover of Ladera Ventures Corp, an oil and gas company, which is currently the trending strategy for cannabis companies in both the United States and Canada for listing on stock exchanges in the Great White North.

However, conflicting regulations in both countries are making it difficult for companies in both countries who want to gain access to capital markets. While Canadian companies are listing on US stock markets, American cannabis companies are going for the Canadian Securities Exchange.

MedMen will trade as MMEN, and they are now the biggest company on the CSE. They are expected to be the most valuable public US cannabis company so far. “The Canadian Securities Exchange.. gives us the fastest access to liquid capital that we can get at this point,” says MedMen senior vice president for corporate communications Daniel Yi. “We are already in three states and we have a lot of projects that are in the pipeline. Our ability to raise capital fast is what will also allow us to grow and build faster,” he adds.

MedMen hopes to create a brand with upscale shops similar to the Apple Stores. They already have 12 shops in California, Nevada, and New York, as well as one that just opened on Fifth Avenue in Manhattan last month. Four cultivation facilities are either under construction or already build. The company employs 800 people, and have already raised around $135 million in venture capital and private equity.

The fact that cannabis is federally illegal in the United States means that American companies can’t list on the big American stock exchanges, and only trade over-the-counter; making Canada’s exchanges a lucrative alternative especially the CSE.

“We’ve got an existing ecosystem of dealers and investors who will support investment in these companies,” says CSE chief executive Richard Carleton. The CSE currently lists over 70 cannabis companies, and over 20 with presence in the United States. “The entrepreneurs in the space look at the valuations that companies both with the US operations and Canadian operations have, and they think, ‘Alright, it would be nice to get some of their early stage investors some liquidity at the valuations that are present on the Canadian public markets,’” Carleton said.

Yi explained that for MedMen, the listing is more about the ability to raise capital quickly. “Raising capital through private equity or venture capital… you are essentially raising two or three million at a time, and you’re having a lot of meetings with family offices, wealthy individuals. It’s a much slower pace of raising capital than it would be in a public market,” Yi said.

“Going public gives us the opportunity to use our valuation and our stocks to also fund our venture going forward,” Yi said, referring to companies like Aurora Cannabis Inc. and Canopy Growth Corp which have been successful in acquiring significant assets through stock instead of cash.

MedMen also plans to join the Canadian recreational cannabis market “as soon as the Canadian Government will allow us,” says Yi. Last March, they announced a joint venture with Cronos Group Inc., a licensed Canadian cannabis company, to create MedMen Canada Inc. Through the partnership, they intend to introduce MedMen retail brands to provinces like British Columbia and Alberta, where private retail sales will be permitted.

“We would operate it day-to-day, because we have the operational expertise on the retail side. Cronos obviously has the infrastructure for the cultivation and production, and the licensing infrastructure for Canada,” added Yi.

MedMen has experienced exponential growth, similar to the nature of other cannabis companies. Just two years ago they had one dispensary located in West Hollywood, as well as one grow op. The injection of $143 in capital with the reverse takeover was led by Cannaccord Genuity Corp. and Cormark Securities Inc. MedMen shares went for $5.25, says Vahan Ajamian, a former analyst for Beacon Securities Ltd who joined the team of MedMen last week as a managing director for analyst relations, which implied a pre-listing worth $2.14 billion.

So why did the stock tank 25% in the first 48 hours of trading? One, the valuation was set way too high for the assets MedMen is putting forth currently, and two, the executive compensation package for the top 2 executives at MedMed is insanely valued. As Debra Borchardt reported on Green Market Report:

Matters weren’t helped when a story from Equity Guru was published the day before the stock began trading. The story did not mince words and said, “This MedMen deal is rank AF.” Readers should probably know what the AF stands for.

The story mostly highlighted that CEO Adam Bierman was set to receive $1.5 million a year in pay for the next four year, plus $10 million in redeemable units. Ultimately Bierman gets $26.5 million from the get-go. Co-founder and President Andrew Modlin gets the same deal. Equity Guru wrote, “So, of the $100 million raised in new shares going public, $53 million of it goes straight into the pockets of the big two.”

The story also warned potential new shareholders that they would have no shareholder voting rights because the majority of voting rights are held by the top executives.

MedMen in return posted its own sponsored content story on Cannabis Financial News calling the company “A compelling opportunity to invest in the cannabis industry.” The only financial figure given in the story about the compelling opportunity was that MedMen had a $1.6 pre-market valuation. MedMen’s initial valuation grew as a result of an investment by Captor Capital which lists Andrew Modlin as a consultant.

Merida Capital Partners jumped into the fray on Twitter calling out the “insane terms in the prospectus” and chastised investors saying, “Did you even read the OC?”

Marijuana Stocks asked if it will be the biggest pot stock to flop and the Wolf of Weed Street (Jason Spatafora) gave a snarky, “What do you think?”

Nikola Zivkovic wrote on Twitter, “Can you name a more flagrant and borderline criminal compensation structure of a recent issue than MMEN?”

SenorWeedStocks said, “G’morning folks, remember to NOT buy $MMEN today.”

Betting Bruiser said, “$MMEN Most Overvalue Potstock to date.”

Stay tuned as MedMen trades under the stock ticket symbol MMEN and you can check the price here.

UPDATE June 1, 2018

Cannabis.net talked to Jason Spatafora of MarijuanaStocks.com to try and find out what happened on the IPO, why the industry threw serious shade and MMEN, and were if the bottom?

> 1. At what price is MMEN a good value based on their fundamentals? Where is the bottom basically? Are we talking $3, $2, $0.50?

If I’m being honest I think they should have stayed private. In a hyper-inflated market I think $100m Valuation would have been fair given the revenue they’ve made around $8m in revenue, but when you add a $43m loss, .7% shareholder voting rights and insane executive compensation where all the money they raised gets put directly in executives pockets I think the company should be halted or have a valuation of $50-70m. This would put it below .50.

> 2. Why go public with that valuation and executive compensation package, they had to know they were going to get killed for it? Or was that part of a master plan?

The fact that Adam Bierman thought this was an acceptable go public strategy shows how unprepared he was to helm a company in the capital markets. CEO’s don’t take $1.5m salaries, they take options and stock that is escrowed for long periods of time. This was a pure and simple money grab that is so blatant. MedMen is a real business, the dispensaries are beautiful, but investors need to realize that a public company is a completely different and desperate animal. If capital structures are as bad as this one they spell disaster for shareholders.

> 3. How can MMEN build up value quickly? More dispensaries in NY? Bigger grows in other states? Where should they look to add value?

Give voting writes to all investors, get rid of executive compensation all together and make it performance based with 3 year lock up period.

> 4. Long term, where do you see this stock in a year? Higher than $5 or lower?

I see this stock as a cautionary tale to all investors that see the potential of the Cannabis industry, but fall victim to the glitz and glamor of a company like MedMen before reading the fine print. I wouldn’t be shocked if there was a class action lawsuit down the road. I see this company as a black eye on the industry that will be thrown in Wall Streets face.

OTHER STORIES YOU MAY ENJOY...

MEDMEN BANKRUPTCY MIGHT HAPPEN, READ THIS.

OR...

NASDAQ MARIJUNA STOCKS, CLICK HERE.

OR..

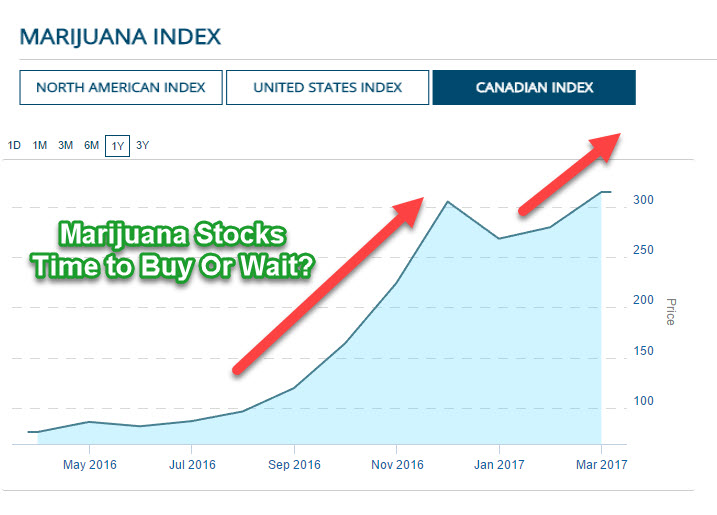

MARIJUANA STOCKS, TIME TO BUY OR PUMP THE BREAKS, READ THIS..