Manitoba repeals 6% retail levy on legal marijuana sales

A mandate that legal cannabis merchants must pay a 6% "social responsibility tax" based on their total annual sales to the government has been revoked in Manitoba.

The action may put around $7.8 million (Canadian) more in the coffers of firms that have been having trouble due to intense competition and low-profit margins.

In 2022, the province sold 181.68 million Canadian dollars' worth of cannabis under regulation.

The number of open stores in Manitoba right now is about 178.

"This will help Manitoba's legal cannabis retailers of all sizes maintain margins while reinvesting in their businesses so they can better compete with a well-established illicit market," Raj Grover, CEO of retailer High Tide, said in a statement.

Call for Further Reforms to Support Canada's Legal Cannabis Industry

Although the announcement is a good start, much more must be done, especially by the federal government, to ensure the sustainability of Canada's legal cannabis industry, which directly employs tens of thousands of Canadians but is having difficulty thriving in the face of the country's current regulatory and legislative framework. In order to ensure that our business keeps expanding and creating jobs while safeguarding public health, Grover added, urging other provinces and the federal government to follow Manitoba's example and develop real steps.

Last November, the province of Manitoba introduced Bill 10 to eliminate the fee. This week, it received approval from Manitoba's legislature.

In a bulletin issued to retailers in May, the province announced a temporary suspension of the payment process for outstanding fees dating back to November 2022. Additionally, refunds will be granted to stores that have already fulfilled their social responsibility fee obligations.

The bulletin clarified that the province is actively working towards issuing refunds for the 2022 assessment payments, either partially or in full. However, these refunds are contingent upon the formal passing of Bill 10 into law.

Raj Grover estimated that these retroactive payments could reach a total of CA$ 18 million.

Manitoba's decision to repeal the fee aligns with the growing pressure on federal and provincial governments in Canada to alleviate the levies imposed on legal cannabis businesses.

Ontario's government-owned wholesaler, for instance, has announced a reduction in the markup on cannabis edibles from nearly 45% to 25% and vapes from over 36% to $25. This adjustment is projected to generate an additional CA$ 60 million annually for the industry.

Notably, the Ontario Cannabis Store stands as the most profitable cannabis corporation in Canada.

According to Statistics Canada, various levels of government in the country collected over CA$1.5 billion in cannabis profit and tax revenue during the fiscal year 2021-22.

Manitoba Explores Federal Excise Tax Partnership

The proposed legislation does not specify the kind of tax that may be used. Still, Manitoba is already in talks with federal representatives about the prospect of joining the other provinces in implementing the federal excise tax, which is already in place.

The provinces, territories, and Ottawa each receive 25 to 75 percent of the excise cannabis tax proceeds in these jurisdictions.

Only the federal portion of the excise tax ($0.25/gram of flower) is levied in Manitoba. If the province were to opt for a share, the tax would be higher, with the provincial portion amounting to $0.75/gram of flower.

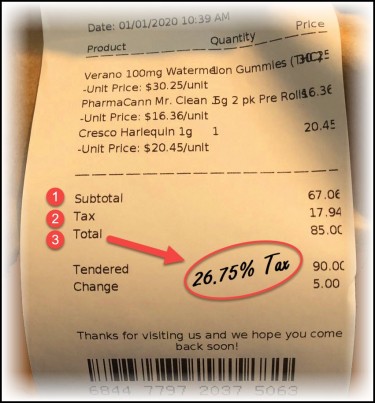

The current social responsibility fee is set at six percent of a retailer's gross revenue derived from the sale of recreational cannabis. This fee was initially introduced in 2018, as the government deemed it necessary to address the financial burden resulting from the various health, safety, education, and enforcement implications associated with legalised cannabis.

Presently, retailers are required to make a lump sum payment during the summer, ranging from $50,000 to $75,000 for certain cannabis stores, as highlighted by cannabis advocate Steven Stairs, who represents the Cannabis Business Association of Manitoba. Stairs further noted that the cannabis retail market in Winnipeg is already oversaturated, with nearly 100 stores, and this levy exacerbates the financial challenges local independent businesses face.

"We are pleased to see the government taking this action as it has been adversely affecting the profitability of these businesses," Stairs remarked.

Impact on Merchants and Potential Legal Implications

Tom Doran, the proprietor of Winnipeg's Jupiter Cannabis store on Academy Road, draws attention to the difficulties in making ends meet that merchants still face after adding the social responsibility fee to the cost of goods. Removing the tax would significantly increase working cash, enabling firms to invest in inventory and other crucial areas in a market that is quite competitive and has a lot of stores.

This charge rollback may be the difference between many retailers remaining open and closing their doors. Doran notes that Manitoba's smaller cannabis companies struggle since there are no limitations on the quantity or closeness of merchants. Furthermore, the lack of minimal profit margins permits larger businesses to undercut prices, thereby squeezing out smaller rivals. Eliminating the levy would level the playing field, and these smaller businesses would be protected.

The levy has been contested in court by the Long Plain First Nation, which claims it is an illegal provincial tax that breaches the restrictions on using reserve territory. The government may resolve this difficult matter and avert additional court disputes by eliminating the fee. Removing the tax will save the provincial government from legal issues in addition to helping particular businesses.

Bottom Line

It is a move in the right direction to assist the industry's profitability and competitiveness that the social responsibility fee for Manitoba's licensed cannabis retailers has been eliminated. While this step deserves praise, more extensive federal reforms are required to guarantee the long-term viability of Canada's legal cannabis business. The removal of the levy is in line with mounting calls for governments to reduce onerous taxes on cannabis firms. The fact that Manitoba is considering a partnership with the federal excise tax system also suggests a direction for future cooperation and revenue sharing. However, in order to support the industry's growth and job creation while preserving public health, it is essential to address the larger regulatory and legal environment. The tax is eliminated by raising working capital and levelling the playing field for firms. It also aids the provincial government in avoiding any legal problems. The expansion and viability of Canada's legal cannabis business depend on ongoing initiatives and improvements.