In 2022, illicit cannabis sales soared to over $74 billion, surpassing the legal market's $28 billion by a remarkable 164%, according to the latest report from New Frontier Data on American cannabis consumers. This significant disparity highlights potential opportunities for legal businesses to attract frequent users who currently depend on unregulated sources, as well as the millions of adults interested in cannabis but hesitant to try it.

Canada has a similar problem, as only 20% of the legally grown cannabis get sold to customers on the legal market.

To delve into the issues contributing to the industry's multi-billion-dollar challenge, New Frontier Data surveyed over 5,500 U.S. adults from various market segments. Conducted in the first quarter of 2023, this demographically representative survey includes consumers who obtain cannabis through a wide range of sources.

Snapshot of U.S. Cannabis Consumers

-

42% of U.S. consumers obtain cannabis from state-regulated markets.

-

34% live in adult-use markets.

-

8% are registered patients in medical-only markets.

-

24% have access to state-legal cannabis but do not primarily use licensed retailers.

-

17% live in adult-use markets but obtain cannabis from friends, family, or illicit dealers.

-

7% live in medical-only markets but do not participate in their state's medical program.

-

34% do not have adequate access to legal cannabis in their state and would require policy reform to use licensed markets.

-

23% live in states where cannabis is illegal.

-

11% are non-medical consumers in medical-only states.

Converting Illicit Consumers to Retail Customers

While most dispensaries compete with each other to serve the same group of committed legal market customers, significant opportunities exist outside this current customer pool. New Frontier Data's research identifies four key barriers that must be overcome to attract frequent gray-market consumers into licensed dispensary shoppers.

Accessibility

Accessibility is a major barrier for frequent gray-market consumers, who disproportionately live in urban areas and may lack convenient transportation to licensed dispensaries. Similarly, those sourcing from friends and family often do not live near a dispensary. Overcoming this barrier requires businesses to work with local regulators to change zoning ordinances and expand delivery coverage areas. For example, in locations with a high population of senior citizens, like Leisure World in Seal Beach, California, local dispensaries offer shuttle services to bring customers to the store, addressing transportation challenges and fostering loyalty.

By addressing these barriers—price, product variety, product quality, and accessibility—licensed retailers can effectively convert gray-market consumers into loyal customers, expanding their reach beyond the current legal market clientele.

Product Quality

Quality is another crucial factor. Much of the illicit cannabis sold in the U.S. is high-quality flower grown in California. To compete with the gray market, retailers in every legal market must offer in-demand strains with quality that meets or exceeds what is available from California farms. This is especially important for consumers with higher tolerances and experienced palates. Ensuring quality and freshness can help attract frequent users who often source from friends and family.

Product Variety

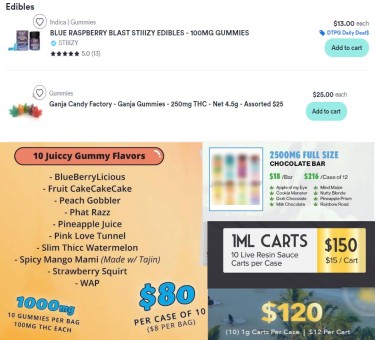

A key differentiator for legal dispensaries is their range of manufactured, non-flower products. Even in adult-use states, fewer than half of surveyed consumers reported access to anything beyond flower, pre-rolls, and edibles. Notably, 25% of frequent consumers in adult-use markets who primarily buy from friends, family, or dealers occasionally visit dispensaries for non-flower products like vape cartridges, concentrates, and topicals. Licensed retailers can better retain these customers by offering promotions that bundle affordable flower with non-flower products.

Price

Price is a significant factor for gray-market consumers, who tend to consume the most cannabis. According to the data, 56% of these consumers use cannabis multiple times per day, with about 32% consuming more than an ounce per month. These frequent consumers often have lower household incomes than those sourcing from friends and family, who in turn have lower incomes than licensed dispensary shoppers. High inflation disproportionately affects low-income households, making affordability crucial. To appeal to this segment in 2024, retailers should offer a variety of products at different price points, with attractive promotions like bulk discounts and one-gram deals. However, heavy taxation in many markets can make price competition challenging.

Capturing the Canna-Curious Market

While current gray-market customers may be entrenched in their habits or face difficult-to-overcome barriers, there are millions of potential new adult customers open to trying cannabis for the first time, or the first time in decades.

According to the report, “Roughly two in five (39 percent) potential consumers in adult-use states described themselves as likely to try cannabis in the next six months. The good news is that for any of these potential consumers who choose to begin consuming cannabis, retail is a likely and attractive source of cannabis relative to the illicit market.”

New Frontier Data's insights into product preferences are crucial for attracting these new customers. A significant 76% of potential customers expressed interest in edibles, 50% are interested in topicals, 42% in beverages, and 28% in tinctures. Only 18% showed interest in smoking flower. Although flower remains a dominant product in retail sales nationwide, dispensaries that effectively market non-flower products have the best chance of attracting a new wave of older, suburban, canna-curious individuals with disposable income.

By focusing on the preferences and interests of these potential new consumers, dispensaries can expand their customer base and tap into a growing market of curious holdouts eager to explore legal cannabis options.

Bottom Line

The dominance of illicit cannabis sales over the legal market in the U.S. underscores significant challenges for the cannabis industry but also presents opportunities. To convert gray-market consumers to legal dispensary shoppers, businesses must address barriers such as accessibility, product quality, variety, and price. Enhancing transportation options to dispensaries, ensuring high-quality products that rival those from California, expanding non-flower product offerings, and creating competitive pricing strategies are essential. Additionally, there is a substantial untapped market among canna-curious adults who are open to trying cannabis legally. Legal retailers can attract these potential customers by focusing on their preferences for edibles, topicals, and other non-smoking products. By implementing these strategies, the legal cannabis market can expand its customer base, convert illicit users, and strengthen the industry's overall growth and sustainability.