On Tuesday, U.S. cannabis stocks dropped significantly after hopes for cannabis regulatory reform fell through in Congress. Specifically, adopting a cannabis-focused proposal in the National Defense Authorization Act (NDAA) is doubtful since a familiar opposition has raised concerns again.

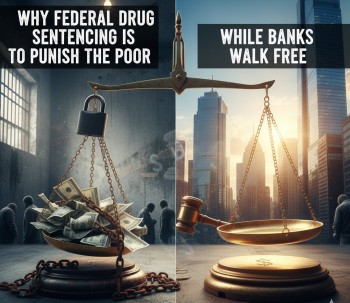

Republican leaders have opposed attempts to add a draft of the Secure and Fair Enforcement (SAFE) Banking Act to the must-pass yearly National Defense Authorization Act (NDAA). The SAFE Banking Act, if passed, would prohibit federal banking regulators from enforcing fines on banks and other financial institutions for offering services to legal cannabis firms.

Democrats lobbied for cannabis banking provision to be included in the NDAA and approved by the Senate before they lose control of the House next year. However, time seems to be running out for the Democrats. In July, the House passed the NDAA, which included the SAFE Banking Act. But, the Senate's treatment of the cannabis bill this year is similar to how the chamber approached it a year ago when senators also removed it from the NDAA.

Opposition From Republican Leaders

Over the last week, investors have been bumping cannabis stocks in the hopes that the SAFE Banking Act, appended to the NDAA by sponsor Rep. Ed Perlmutter in July, would be in the final draft of the must-pass yearly defense funding measure. As it stands, Mitch McConnell, the Senate Minority Leader, is opposed to its inclusion, claiming that enacting SAFE Banking will make the banking system more friendly to illegal substances.

According to Mitch McConnell, Senate and House Democrats are still delaying efforts to finalize the NDAA by cramming in irrelevant things with no connection to defense. McConnell further remarked on the Senate floor on Tuesday that such an attempt is a jumble of pet priorities, such as making our financial system more friendly to illegal narcotics or the bogus, politicized licensing amendment and name-only language that failed to clear the Senate earlier this year.

The Kentucky Republican's critique isn't encouraging for SAFE Banking's chances of inclusion in the NDAA, as approval from Congress leadership is required for SAFE's inclusion. Although ten Republican senators might still vote in support of the proposal, this isn't the easiest route to take.

Mitch McConnell's resistance to SAFE Banking is nothing new for him; as Senate Majority Leader during the Trump administration, he has persistently rejected any attempt at federal reform.

More recently, McConnell chastised Democrats early this year when SAFE Banking was included in the House bill of the America COMPETES Act. He commented that Democrats are too desperate to have measures on cannabis banking. Undeterred, President Biden approved the CHIPS and Science Act later that summer. It was substantially derived from the U.S. Innovation and Competition Act and its House counterpart, the America COMPETES Act.

What's Next For The Democrats

The NDAA was announced on Tuesday with no mention of cannabis, shattering any hopes that legislation authorizing cannabis banking would be passed by the end of the year. The House early this year approved a version of the NDAA that incorporated the text of the SAFE Banking Act. The SAFE Banking Act has received broad bipartisan support to date, and it is thought that Republicans opposed using the NDAA as a tool for this reform.

According to Bloomberg, the bill's chief Democrat proponent, Sen. Jeff Merkley of Oregon, announced on Wednesday that he will try to attach SAFE Banking to an omnibus budget bill before the December 16 deadline.

Democrats are not working alone. The bill has the support of nine Republican senators, but Democrats need 10 to avert a stalemate. Democrats may fare marginally better next year, with 51 senators in their party, requiring nine Republicans — which they already have, assuming no cross-party co-sponsors have a change of heart.

Senator Steve Daines of Montana, the bill's primary Republican supporter, told Bloomberg on Wednesday that supporters are meeting with Senate and House counterparts and looking to see if there's a road ahead.

"The priority right now is trying to get it done in this Congress before the end of the year, and we'll see what transpires after that," he told Law360. After then, chances drastically reduce.

Another possibility is to merge SAFE Banking with some other cannabis-related bill. For example, the HOPE Act would use federal funds to pardon state-level cannabis convictions. But in an unexpected twist, two Republicans who co-support SAFE Banking are highly opposed to the bill being attached to other accounts.

"If those legislation haven't had the strength and legs on their own to obtain time on the floor, the thought of adding all of that to an omnibus that nobody gets to read before they vote on is completely despicable to me," said Sen. Cynthia Lummis, R-WY. According to Sen. Kevin Cramer, R-ND, including SAFE Banking in an otherwise unrelated bill "dilutes the proper purpose of this place,"

If SAFE Banking is not included as an extension to the NDAA, it may be pushed until fiscal 2023 omnibus discussions. SAFE Banking could be reintroduced in the House, which has already been passed seven times. However, attempts would continue in the absence of the bill's principal author, Rep. Ed Perlmutter, D-CO, who is exiting Congress.

"We successfully elevated the problem and had everyone's attention," Perlmutter remarked to Law360 after SAFE Banking was removed from the NDAA. "So now we have to get it done." There is still time." Other politicians will follow this up from where Perlmutter stopped. The co-chair of the Congressional Cannabis Caucus, Rep. Earl Blumenauer, D-OR, stated that the campaign to pass SAFE Banking will not end until this session's final minutes.

Final Thought

The SAFE Banking discussion hasn't necessarily been occurring in a bubble. Last week, 44 state banking associations and the Independent Community Bankers of America (ICBA) wrote to Senate leaders, encouraging them to consider the SAFE Banking Act a standalone bill or an amendment to other legislation before the end of the year.

On the day, cannabis stocks in the United States, as represented by the MSOS ETF, plummeted 12.84%, falling just short of the 11.44 million trading volume on Monday. Tilray Brands (TLRY) and Canopy Growth (CGC) fell by 13.25% and 16.44%, respectively.

MITCH MCCONNELL ON WEED, READ ON...

WEED WILL BE LEGAL IN THE US WHEN MITCH MCCONNELL SAYS SO!