A dispensary in St. Louis County initiated a lawsuit against Missouri, asserting that imposing multiple sales taxes on recreational marijuana sales by municipalities and counties is unconstitutional. In Kansas City, two counties, Jackson and Cass, have been stacking sales taxes. This action was prompted by voter approval in April, which endorsed county and municipal taxes, each set at 3% for recreational marijuana sales.

The plaintiff in this case is Robust Missouri Dispensary 3, and their dispensary is situated within the city of Florissant, which is located in the northern part of St. Louis County.

In February 2023, the Missouri Department of Revenue released a statement that offered clarification, stating that, according to the lawsuit, it's not permissible for a city and a county to impose an additional local tax of up to 3% on recreational marijuana sales, based on the constitutional language.

The lawsuit raises questions about the interpretation of Article XIV within the Missouri Constitution. This article states: "The governing body of any local government is authorized to impose, by ordinance or order, an additional sales tax in an amount not to exceed three percent on all tangible personal property retail sales of adult-use marijuana sold in such political subdivision."

In February, state officials reaffirmed the language within the Constitution, indicating that a "local government" for those residing in incorporated areas refers to a village, town, or city. For those living in unincorporated areas, it denotes a county, as the lawsuit details.

Consequently, St. Louis County dispensaries in incorporated areas are only liable for a municipal sales tax, such as the 3% sales tax passed by Florissant in April. Meanwhile, dispensaries in unincorporated areas are subject to a 3% county sales tax approved by St. Louis County voters in April.

However, in late February, the Missouri Department of Revenue (MoDOR) issued a statement indicating that the language in Article XIV was "ambiguous." As a result, MoDOR rescinded its previous guidance, as per the lawsuit.

The statement acknowledged the existence of "two interpretations" regarding the definition of "any local government." It declared that MoDOR would no longer advise municipalities or counties regarding stacking sales taxes on recreational marijuana.

The plaintiff received a "Sales Tax Rate Change Notification" letter, dated October 2023, from the Director of Revenue for the State of Missouri, Wayne Wallingford. The letter conveyed that both Florissant and St. Louis County had requested to impose 3% local government taxes on sales at Robust Missouri Dispensary 3, commencing on October 1, 2023. It emphasized the business's obligation to comply with this directive.

The plaintiff seeks a resolution in court regarding the constitutional interpretation of Article XIV, specifically whether Missouri counties can legally apply additional sales taxes alongside municipal sales taxes for businesses operating within incorporated areas.

Furthermore, the plaintiff is seeking an injunction against imposing St. Louis County sales taxes on recreational marijuana sales at their Florissant dispensary. The plaintiff asserts that these additional sales taxes would cause "permanent" damage to customer relationships, as indicated in the lawsuit.

Confusion over the Legality of Stacking Taxes for Recreational Cannabis

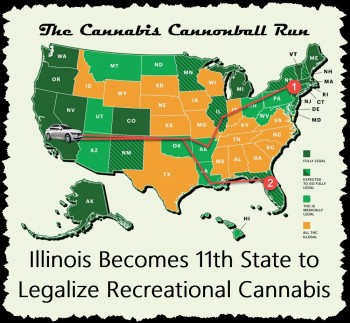

Starting October 1, a supplemental 3% tax is applied to the sales of recreational marijuana in all cities and counties that enacted ordinances in April. Amendment 3, passed in November 2022, which legalized recreational marijuana sales, also extended the option for cities and counties to introduce taxes approved by voters.

This additional 3% tax is layered on the existing 6% state sales tax. Consequently, Columbia and Jefferson City residents who purchase recreational marijuana are subject to a total tax of 12% in addition to the regular state sales taxes.

During his visit to mid-Missouri for a church event, Wayne Brinkley, a San Antonio resident, received a receipt totaling $155, which included an additional $5.90 in state taxes, $7.32 for the Jefferson City tax, and an extra $6.10 for the Cole County tax. Brinkley expressed strong disapproval of this three-part stacked taxation on marijuana.

"I don't think it's acceptable at all," Brinkley remarked. "They seem to be dipping into our wallets at every opportunity, taxing our earnings." Before this, KOMU 8 News had reported on the confusion surrounding the stacking of these taxes. Even with the taxes now in effect, the uncertainty persists.

Jack Cardetti, the spokesperson for MoCannTrade, believes that cities have handled the ballot initiative correctly. He asserts that the Missouri Constitution permits local government to impose a 3% tax on adult-use sales. The Constitution defines a "local government" as an incorporated area encompassing villages, towns, or cities, and in the case of unincorporated areas, a county.

As per Cardetti, counties should only be collecting taxes from sales made in the unincorporated regions of the county. Cardetti views any counties attempting to gather these stacked sales taxes as nothing short of a financial grab.

Cardetti explained, "Their intention seemed to be, 'We understand that the sales within city limits are meant for the city, but we'll attempt to collect that sales tax as well.' That's not in line with Missouri law, and we're concerned it will only encourage the black market."

Boone County Commissioner Kip Kendrick stated that the Missouri Department of Revenue (DOR) initially concluded that stacking these taxes was permissible. However, Cardetti contends that the DOR withdrew their guidance, stating they "would not advise municipalities or counties on the possibility of stacking, based on the language in Article XIV of the Missouri Constitution."

According to Kendrick, Boone County anticipates receiving the initial tax revenues generated later this year or early 2024. He mentioned that the county plans to reserve the revenue from city taxes while the legal confusion is resolved in court.

"We anticipate that it will be resolved through the legal process. Boone County's approach is to set aside the funds we receive from sales in Columbia," Kendrick clarified. Cardetti anticipates that litigation will enter the circuit soon, and while it remains uncertain who will be named as defendants in this case, Kendrick does not foresee Boone County's involvement.

Conclusion

The ongoing legal debate over the stacking of taxes on recreational marijuana sales in Missouri has created uncertainty and controversy.

Residents like Wayne Brinkley express frustration at the additional tax burdens. At the same time, proponents like Jack Cardetti argue that the practice goes against the state's legal framework and may inadvertently foster illicit markets. The conflicting guidance from the Missouri Department of Revenue has further added to the confusion.

Boone County Commissioner Kip Kendrick expects the matter to be resolved through legal proceedings, and Boone County is preparing for the eventual outcome. As this issue unfolds, it remains a subject of legal contention, with potential implications for tax collection in various jurisdictions within Missouri.

CANNABIS TAXES ARE A BOOM FOR STATES! READ ON...

$5.7 BILLION IN CANNABIS TAXES IN JUST 18 MONTHS? CLICK HERE!