What Will Happen to Dispensaries with Federal Legalization? – Look North, Young Man, Look North!

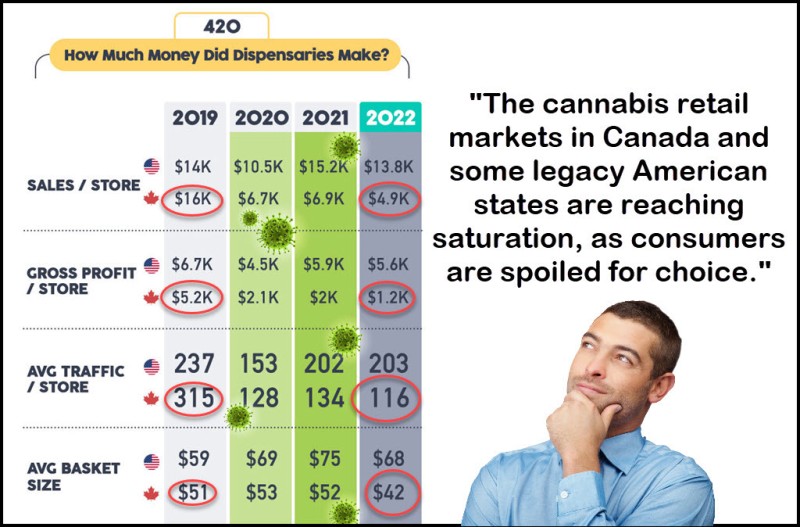

Interesting piece put out by the COVA POS ordering system and LinkedIn polling over the 4/20 holiday. Highway 33 organized the data in easy-to-use infographics, and while the US market is choppy and could be explained over the past year with state-by-state legalization and then the COVID pandemic, Canada is a screaming warning to the US cannabis industry on what full Federal legalization looks like after a few years.

While Canadian cannabis users have a massive illicit market, as well as a massive oversupply of legally grown weed that is getting sold in dispensaries. As we have talked about ad nauseum at Cannabis.net, the margin compression game will be coming to America any year now and investors, owners, managers, and everyone else better be ready for lower retail prices, lower profit margins, a bigger illicit market that will become even tougher to crack down on, and higher taxes. As Highway 33 printed and summarized the findings:

However, in 2022, the overall sales per store and average basket size declined a bit in both countries. This can likely be attributed to the following factors:

-

The cannabis retail markets in Canada and some legacy American states are reaching saturation, as consumers are spoilt for choice. Cannabis shops in Manitoba recently outnumbered Tim Hortons stores, and Ontario’s cannabis market has grown exponentially from just a few stores in 2020 to over one thousand in 2022.

-

During the pandemic, Americans and Canadians received a lot of stimulus cheques from their governments and had excess money to spend on cannabis while they were locked indoors due to restrictions. As we revert to a certain sense of normal, people are likely spending more money on other regular recreational activities now.

-

In 2022, we’re witnessing the highest inflation in decades, which is likely another factor impacting the average basket size on 4/20/2022 in both the US and Canada.

-

People likely stockpiled over the Easter weekend, which was just a few days before 420.

If you look at the first graphic, the drop in margin, orders, and profit of legal cannabis in Canada is breathtakingly stunning to say the least.

Now, fast forward to a second graphic Highway 33 used from MJ BIZ, the profitability of MSOs in America right now. Check the revenue numbers from 2020 to 2021, they look great! Now check out the fact that only 2 MSOs are actually profitable, and those two are needing close to a billion in revenue to turn a profit. Let that sink in, an MSO right now has to start getting in the billio- dollars-in-revenue neighborhood to start showing decent profits.

That is before full Federal legalization in the US, before interstate commerce kicks in, a bigger illicit market, and consumers having many more options to get cannabis compared to what they have right now.

You have Canada, just to the north of us, to show you what happens when you have way to much cannabis for your population. Canada barely has more people than the state of California, but it acts as a great future-looking experiment for the American cannabis industry. Want even worse news if you are a brick-and-mortar cannabis company? Interstate commerce will destroy walk-in retail like Amazon did to the standard US shopping mall. What happens when international commerce starts and low cost-of-labor, low cost of electricity, and areas that have sunny days 330 days a year come online and start exporting cannabis. Columbian companies claim to be able to grow premium outdoor cannabis for a $1 a gram. That will decimate margins of US cannabis growers that need to abide by labor laws, electrical prices, testing, non-pesticide use, etc.

If margin compression and market saturation will also be the future of the US cannabis industry, what can a business do to protect its market share and profits? As we have mentioned before on this site, if the margins are compressing on the bottom line, you need to find some margin on the top line, acquiring a customer for a $0.01 and not $50. That is where cannabis sites with organic internet traffic that can convert those eyeballs to orders will win the day. The MSO that grabs up as much digital real-estate in the cannabis industry will be able to build out those sites into millions of views per day and turn those page-views into customers. Take internet traffic from the biggest cannabis websites and send them to a one of your dispensaries near them or ship them orders through your rewards program and online shopping cart.

In the end, cannabis is a commodity, and commoditization has already begun in mature legal states. The sales data shows it, the customer surveys also all show it. Customers remember price, effect, and how far they had to go to get the product. They don’t care about your packaging, your story, or if “your weed is so much better than anything out there”. Price, desired effect, how long did it take me to get it, that is what all customer surveys have shown so far in the cannabis industry. Budweiser and Bud Light make up 90% of beer sales in America, not because it is the best tasting beer or has the best packaging. It is cheap, it is always close, and it gets the desired job, or effect, done.

COMMODITIZATION AND SATURATION IS THE FUTURE, READ MORE...

CANNABIS PRICE COMMODITIZATION HAS BEGUN IN AMERICA, READ THIS!