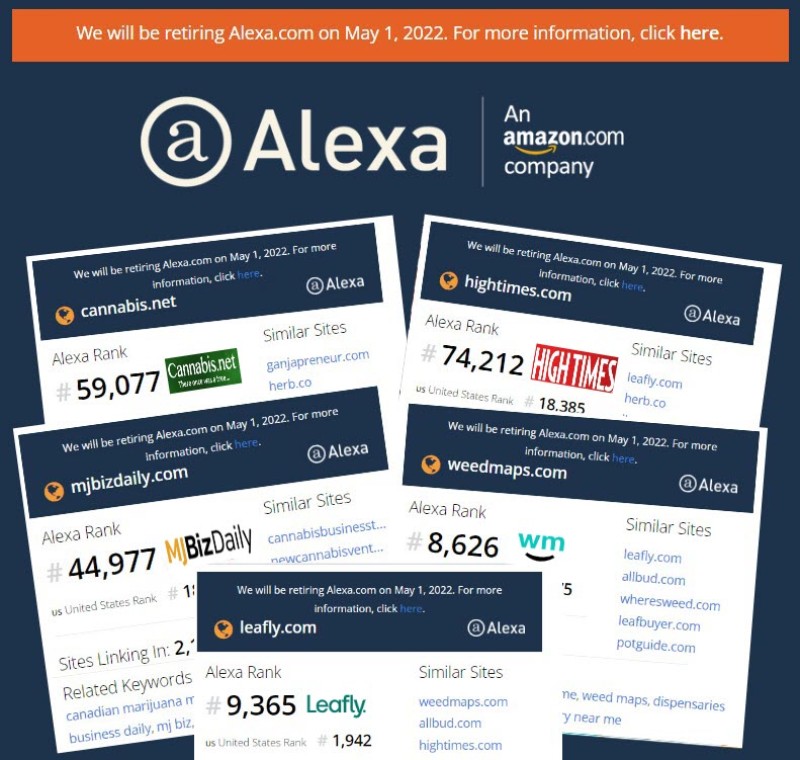

Alexa web-tracking run by Amazon is getting retired by the ecommerce giant in May, but not before giving us one last look at who has internet traffic and visitors in the cannabis space. Which sites have the most traffic in the cannabis industry? Well, while Alexa web-ranking has its supports and detractors, we have to acknowledge that no system is perfect and can see an entire website’s user base. Without looking at the Google Analytics or server logs, there is no real tried-and-true way of knowing a website’s true reach and traffic. A good example is us, Cannabis.net, we have a mapping and social network app for cannabis fans in the Google Play store and Apple iTunes store, so all our members using the app to access our social network, map, and stories don’t show up on our website analytics. Other sites have similar stories, to the Alexa numbers are just a “50,000-foot level” view of traffic and users in the cannabis websites.

If you remember the first article we did 2.5 years ago on marijuana sites with traffic, we set up some ground rules. Let’s go over them, again. One, this review is just for cannabis websites, not big sites that have cannabis reporters and sections. For example, Forbes and Benzinga have excellent cannabis writers and sections devoted solely to cannabis news, but they are not cannabis websites. You can go pull up Forbes.com and Benzinga.com and see they are financial news and stock market sites first and foremost, with great cannabis sections and reporters. Same goes for the Wall Street Journal, Yahoo, and even CNN. This review is of cannabis-based websites, not big sites with cannabis sections on them.

Second, Alexa has been in the process of shutting down for 8 weeks and everyone’s traffic numbers are dropping as they turn of contracts for router information, server logs, etc. Generally speaking, everyone’s numbers are “worst” right now than they have been for years, but since it applies to all industries and sites in Alexa ranking, we will keep it as the same effect on all. Just as the Google Medic update slammed cannabis websites, new waves of Google updates can shift rankings as well.

With the NFL draft this weekend, I thought of doing a “draft review” type article on cannabis websites. The biggest winners, the biggest losers, and the surprises since we checked these numbers 2.5 years ago. Let’s get to weed website talk and opinion!

The Elephants in the Room

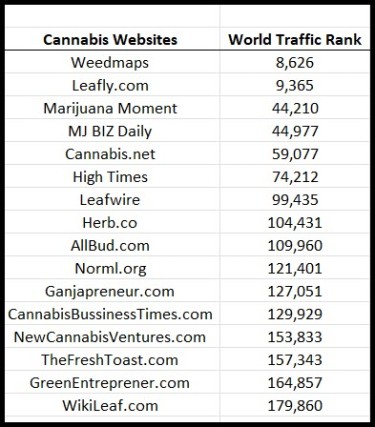

Weedmaps and Leafly are by far the two most trafficked cannabis websites in the world. Both are now publicly traded on Wall Street and at one point both had over a $1 billion valuation. Leafly was part of the Peter Thiel cannabis empire early on and had over $50 million in funding, with which they built out the internet’s best strain guide and strain review pages. Weedmaps has been a pioneer on the internet side for the cannabis industry for over 30 years now, making the first and most successful mapping system for finding dispensaries and MMJ doctors on the internet. In the cannabis space, there is Weedmaps and Leafly, and then the rest of the list starts. Just like in pro sports draft some years, there are two top picks competing for the #1 rank, then picks 3 to 10 is where the real draft starts for everyone else.

Both are leading the charge for online ordering and in-app ordering by fighting Apple, Google, and the even the State of Florida to allow online ordering through 3rd party platforms.

The Next Group to Make up the Top 5

The newspapers of the cannabis industry, and the Swiss-army knife of the industry come in the next grouping as MJ BIZ Daily, Marijuana Moment, and Cannabis.net round out the top 5 for most traffic. MJ BIZ Daily is the Wall Street Journal of the cannabis industry, and also runs the largest trade show for the industry in Las Vegas each year. Chris Walsh has done a great job building the digital and physical footprint of MJ BIZ for 10 years now. So good of a job, MJ BIZ was just bought by Emerald X for $120 million.

Marijuana Moment is the Washington, DC insider for the cannabis industry. Tom Angell and his staff provide breaking news and reviews of all legislative discussion and movement related to the marijuana industry in DC. The site is non-profit and relies on ads and reader donations to keep the Washington, DC side of the marijuana industry covered.

Cannabis.net rounds out the top 5, sporting over 4 new articles every day, a full social network for cannabis users, full dispensary and cannabusiness mapping, a job board, a cannabis strain guide, a CBD store for now, and an events calendar of cannabis activities coming up in your area. Their strain guide has been moving up in ranking this year, as well as the “dispensary near me” keywords.

After the Top 5 – Some Risers and Some Dropping

High Times, Leafwire, Herb and AllBud are bunched up in the next part of the draft based on internet traffic numbers according to Alexa. High Times has had a tough stretch with their never-ending IPO journey, and their website traffic has taken a hit as Adam Levin manages a tighter budget and trying to figure out how to get public based on his current number and market conditions. High Times recently branched into the dispensary-branding niche, with a few locations in California now sporting the High Times logos and colors. A move a dispensary might try in order to distinguish themselves from an over-crowded field in California.

Leafwire is the LinkedIn of Weed, founded by Peter Vogel, and after a crowdfunding campaign and a private investor raise, has seen his site’s traffic rise over the past 12 to 18 months. A great feat considering they are a social network that has user postings and not as much content created as the other sites on this list.

Herb is a Canadian-based site founded by Matt Gray and had a nice $5 million investment from a boutique Canadian investment firm to start the process back in 2016. Orginailly the site was called "The Stoner's Cookbook" before Matt bought it and rebranded it as Herb. While many have debated his strategy of building up a big Facebook and Instagram following instead of focusing on building up his own URL, the move has not bitten him back, yet. Moving users from non-friendly cannabis social media sites to his own website property will be a priority for longer term growth, but Herb does have a large variety of hemp and CBD advertisers.

Allbud is a high riser that keeps the site simple. Dispensaries, news, culture, strain guide, but the hook is that AllBud will actually show you who is selling the product or strain near you if you agree to the cookies on the browser. While some of sellers may not quite have “correct licensing”, if that doesn’t bother you, it is a good hook up to find and buy cannabis, whether on the illicit or legal market.

Just Outside a Top 10 Pick – Who Surprised?

Norml is the cannabis industries legal eagles, the lawyers of the marijuana industry have a trade association and work together to fight for legalization at the state and Federal level.

Ganjapreneur has been a strong website for cannabis news for years and recently added some new advertising features. While the site may look outdated, the content and backend is top notch.

CannabisBusinessTimes – A Fast riser in this draft, not on anyone’s draft boards just a few years ago but thanks to lots of content and a great link strategy, CBT has moved up in the online rankings, at the same time as producing a printed magazine that you can check out at cannabis industry shows and order a copy of from their site.

Rounding Out the Top 15

New Cannabis Ventures is a top financial reporting site lead by Alan Brochstein. While the industry was shocked and saddened by Alan’s recent bicycle accident, thoughts and prayers go out to Alan and his family. The site focuses SEC filings, public companies in the cannabis space, and FTC issues for companies in the weed industry.

The Fresh Toast is run by media legend, JJ McKay. The site has tremendous syndications deals with Wrigley Publishing and medical outlets online. One of the largest consumer-facing websites, JJ may pick up your article and you may see it in Apple News or Flipboard soon after.

GreenEntrepreneur is technically a cannabis website and made the list, even though they are owned and operated by Entrepreneur Magazine and the Entrepreneur websites. Sporting a great management team, Green Entrepreneur has really done a great job of mixing cannabis content with small cap cannabis stock news and information.

WikiLeaf is a product and dispensary review site, with a large variety of strain information and product reviews.

All The Other Metrics

Alexa’s data includes secondary information that Google uses in their secret sauce to determine rankings. Time on site, page views per visit, and bounce rate are all part of Googe’s analytics for determining the quality of a website.

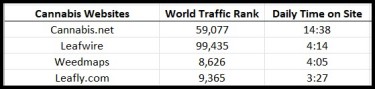

Time on Site – Not surprisingly the two marijuana social networks have the highest time on site. Leafwire and Cannabis.net’s WeedFeed allow users to post, ask questions, engage with private messaging with other members, and that creates high time on site numbers. Social networks are sticky and create many areas for users to poke around on and hence, create long-time on-site numbers.

Page Views per Visit – Cannabis.net and Weedmaps dominate here as both feature dispensary menus and product listings create tons of pages for users to scroll through and read about. Menus and product pages give users time to review and compare, the compare part creates lots of clicks and page view per visit.

Bounce Rate – This number is important to Google, and the lower the better. Bounce rate is defined as “the percentage of visitors to a particular website who navigate away from the site after viewing only one page.” Google sees this as a click someone does, get to the page, and then bounces away back to another site or Google.

If you have a spamming looking homepage or lots of pop-up ads, this could affect your bounce rate as user click on your link and say, “no thanks” and leave quickly.

Leafly, Leafwire, and Cannabis.net have the lowest bounce rates in the group, creating stickiness and engagement right off the bat with their social network signs, mapping, and pictures from recent articles. Some sites try a search bar as their “above the fold” segment of their homepage to lower bounce rate and increase page views. AllBud is one such site you can check out. The theory being that with a search bar as your homepage the user has to take time typing in their query or question, hence decreasing bounce rate, increasing time on site, and once the results of the search come up, clicking on a variety of search result pages to increase page views.

The Future of Cannabis Websites

Monetizing users is the key to cannabis website traffic, and with the failure of full Federal legalization, most marijuana-themed websites have had to create revenue through advertising, sponsored posts, social media blasts, and email campaigns. Most traffic on cannabis websites wants to buy actual cannabis, but since most sites can’t sell cannabis directly to consumers, and certainly can’t ship orders through the mail or FedEx yet, they have to build up eyeballs and traffic until they day they can sell cannabis to those visitors or get acquired by someone that can do that. The main goal would be to convert those high domain and highly ranked sites’ traffic into thousands of cannabis orders a day, orders being shipped around the country and arriving in 2 days or less. Sounds like an Amazon of Weed to me.

Canadian giant Fire and Flower sees this vision and has been active in buying cannabis websites, analyzing the data, and converting those eyeballs to orders, at least in Canada. The future of cannabis sales will be done with a click or a swipe, and in the end, as always, traffic is king. Pot Guide was their latest purchase for over $8 million. Crain Publishing also scooped up Deb Borchardt's Green Market Report in a private deal.

Weedmaps and Leafly are already public companies, MJ BIZ sold for $120 million, High Times is pre-IPO, these websites have tremendous future value as they can convert organic traffic to cannabis orders, but their time has not come yet as the US waits on full Federal legalization. MSOs have to ask the question now, is it better to buy traffic at good value now, or compete against these same sites when full Legalization and interstate commerce kicks in? The MSO winner might be the one who builds the best wall against Amazon, Uber, and DoorDash, build up a moat of cannabis traffic and sites, put all your customers into your rewards program on day #1, and get ready for the future Amazon/Shopify cannabis traffic war that will happen in our lifetime.

WEED WEBSITES, READ MORE...

WHAT ARE THE BIGGEST CANANBIS WEBSITES YOU CAN ADVERTISE ON?