Timing is Everything: When will the IIPR Canary Fall?

In 1983, United Technologies, the industrial conglomerate, began to publish full-page poems in the Wall Street Journal under the name of UT Chairman Harry Gray. One of those poems had a line that read something like “When 10,000 people believe in a dumb idea, it is still a dumb idea” and went on to encourage the reader to believe in oneself. I have followed that advice for nearly 40 years. Sometimes it is a lonely place being the one in 10,001 voices but every now and then something happens to breathe wind beneath one’s wings.

Green Market Report recently reported on a short seller report issued by Blue Orca Capital (Short Seller Attacks Cannabis REIT, April 15, 2022) with respect to Innovative Industrial Properties, Inc. a cannabis-focused real estate investment trust (NYSE IIPR). Blue Orca cited IIPR client Parallel as the canary in the coal mine.

Parallel’s real name is Surterra Holdings, Inc. and was founded by chewing gum family icon William 'Beau' Wrigley Jr. Parallel has gained fame for some of its bold acquisitions, including New England Treatment Access (NETA) whose flagship store, just a few hundred feet from the border with the City of Boston, was, for some time, the only adult-use retail store accessible from Boston’s storied green line trolly system. NETA’s flagship Brookline store made more headlines than Brad Pitt, with long lines, police details, sales reported at $100 million, and a purchase price by Parallel rumored to be $800 million (the purchase included NETA’s other store and their cultivation and manufacturing plant).

Through all the excitement no one seemed to focus on the fact that the City of Boston would eventually have 50+ adult use retail stores and once they opened, NETA’s market exclusivity would diminish. Since mid-2019 it was clear that the Field of Dreams mentality gripping many retail cannabis entrepreneurs was misplaced. You could build it, but there was no James Earl Jones assuring that they will come. Massachusetts cannabis sales revenues have been on an upward trajectory for several years as has the associated tax revenue. That is where the media focuses. Scant attention is paid to tracking annual sales and dividing by annual store days to see that average revenue per store has been on a consistent downward slope. Stores are opening at a faster rate than revenue is growing leading to the average revenue per store decrease.

More stores have opened across Massachusetts (the state passed the 200-store mark in early 2022) and stores have started to open across the City of Boston and in other surrounding communities served by the Boston-based trolly, train, and bus network known locally as the “T” and formally as the MBTA – the Mass Bay Transit Authority. Last rumor circulating through the Massachusetts cannabis community was that NETA’s flagship store was down to $40 million in annual revenue and speculation was that NETA’s continuing revenue decline (which is natural and predictable) was a factor in derailing Parallel’s SPAC plans.

Blue Orca got it slightly backwards; Parallel might be IIPR’s canary, but IIPR is the industry’s canary.

Cannabis is Confusing and the Ability to Raise Capital does not Assure an Understanding of the Market

Cannabis is reminiscent of a well-worn riddle typically posed by the 5-to-9-year-old crowd; what is it – you throw away the outside, cook the inside, eat the outside and throw away the inside? That riddle is much like cannabis; it is illegal at the federal level, legal at the state level, often regulated tightly at the local level (zoning, operating hours, etc.), and tolerated at the federal level via published guidance memos on how to remain out of federal crosshairs.

Just because a team can raise a lot of money doesn’t mean they understand the cannabis market construct. Cannabis as a plant holds many promising applications. Cannabis as an industry is a moving target and many operators seem to be inflicted with ostrich syndrome; if you don’t understand it, just stick your head in the ground and ignore it. This is akin to Dave Barry’s well-read love story of Roger and Elaine where after an encounter with Elaine that leaves Roger not understanding, Barry concludes that “A tiny voice in the far recesses of his mind tells him that something major was going on back there in the car, but he is pretty sure there is no way he would ever understand what, and so he figures it's better if he doesn't think about it.” And so goes big cannabis; ignore the long game and focus on today.

SHADED SIDEBAR

As a short diversion, ask yourself whether you know why the following people are famous in cannabis. If you aren’t familiar with at least 80% of these characters and their stories, beware before plotting long-term cannabis strategy for your organization. It’s time to do some quiet reading.

-

Who is James M. Cole and what is he famous for in cannabis?

-

Who is Timothy Leary and what is he famous for in cannabis?

-

Who is Raymond Shafer and what is he famous for in cannabis?

-

Who is Robert C. Randall and what is he famous for in cannabis?

-

Who is Francis L. Young and what is he famous for in cannabis?

-

How did Dana Rohrabacher impact federal cannabis enforcement?

-

How did Roscoe Filburn inadvertently impact cannabis markets?

-

How might Wellness Connection of ME impact national cannabis markets?

At present, every state that has legalized cannabis requires licensees to purchase product only from other in-state licensees. That creates a patchwork of isolated markets. Supply gluts in the northwest and west coast markets drive prices down while strong demand keeps east coast prices astronomically high, all with no logical way to find equilibrium. That is not how our founding fathers imagined an American economy. Free trade doesn’t stop at the borders.

Back in 2019 and 2020, while investors and real estate professionals were foaming at the mouth to get into cannabis cultivation, I wondered why people would invest so much money to create a long-term fixed asset (a cultivation facility) to grow an outdoor plant indoors – the same outdoor plant cannabis antagonist Harry J. Anslinger (former Commissioner of the Federal Bureau of Narcotics) once stated grows like weeds in a roadside ditch – one might just as well try to stamp out crickets. In 2021 it was estimated that 10% of Massachusetts’ commercial electricity consumption was being consumed by cannabis cultivators – so much for going green.

As I observed in a February 2020 article, indoor cultivation is expensive. A typical warehouse can cost $60 per foot to build. Older mill buildings or wood frame factories can be found for as little as $25 per foot. That means a 30,000-square-foot property can be bought for $750,000. To upgrade these buildings to a grow site can cost up to $250 per square foot—far more than the property was originally worth. But real estate professional after real estate professional looked at me quizzically like how could I not understand the opportunity?

With debt very tight, many larger multi-state operators (known in cannabis as MSOs) turned to the sale-leaseback market to raise capital. The leader in the cannabis sale-leaseback market is IIPR. You can search around and find a few other cannabis real estate funds, but no name is as prominent in the sector as IIPR. IIPR will buy an operator’s property, lease it back under a long-term lease, and often agree to provide a budget for renovations and improvements. When completed, many of these properties rival first class office space in terms of cost per square foot – all to grow a plant indoors that “grows like weeds in a roadside ditch.”

I have developed a hypothesis that commercially grown indoor plants must have a high “fruit-to-plant” ratio to be economical. Here is what that means. Grow a mushroom and everything above the soil is “fruit” (fruit just sounds better than vegetable to plant ratio). Same goes for lettuce and most herbs. Now let’s jump to the far extreme. Think of the size area that would have to be devoted to growing an apple tree indoors and then compare that amount of space to the actual square footage of apples that could be harvested. The yield would be low making indoor grow uneconomical. That is, unless the cost of apples was driven artificially high… like cannabis. As soon as the barriers driving up the prices come down, indoor cultivation will become uneconomical, and all those indoor cultivation facilities will become quickly obsolete. Consider that somewhere around 70% of wine sold is under $15 a bottle or that most beer sales are the run of the mill mass produced beers. Cannabis research has shown that most consumers care about price and effect and don’t understand the names associated with plant varieties (yes, the industry slang is strain, but that is misplaced. Plants have varietals and cultivars. Diseases have strains. But I once again digress…).

So, what will bring prices down? Interstate commerce. And when might interstate commerce happen; soon, much sooner than most realize. But don’t turn to Washington, D.C. Instead, look to Boston and St. Louis. Two federal cases are winding their way through those courts that could turn the national cannabis markets on its head. The east coast case is further along and has advanced from a federal trial court in Maine to the United States Court of Appeals for the First Circuit in Boston. Experienced observers of oral arguments (held April 7, 2022) believe the panel was leaning toward the plaintiff/operators and away from the State of Maine. The case comes down to what is known as the Dormant Commerce Clause. If a federal court rules the DCC applies to cannabis, it means all state regulations that restrict commerce to in-state participants are unconstitutional. All it will take is a simple lawsuit filed against a state regulatory body to quicky overturn the regulatory restrictions on interstate commerce.

But Won’t the Feds Simply Crack-down on Interstate Commerce?

Maybe not. And maybe not for a lack of wanting to do so. In 2014, California Representatives Dana Rohrabacher and Sam Farr secured passage of the so-called Rohrabacher-Farr Amendment. The budget amendment passed the House in May 2014 after six previously failed attempts, becoming law in December 2014 as part of an omnibus spending bill. The amendment has been included in each successive federal budget and presently reads as follows:

“None of the funds made available in this Act to the Department of Justice may be used, with respect to the States of Alabama, Alaska, Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Illinois, Iowa, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, Oregon, Rhode Island, South Carolina, Tennessee, Utah, Vermont, Washington, and Wisconsin, to prevent such States from implementing their own State laws that authorize the use, distribution, possession, or cultivation of medical marijuana.”

That means the commerce of cannabis from a licensed cultivator in one state to a licensed operator in another state, may be easily defensible. It will restrict that commerce to medical use, but in some states, medical plants can be converted to adult-use after the fact.

Locally, we see the process playing out as follows.

-

Wellness Connection of Maine wins its lawsuit against the state of Maine, securing federal affirmation that the DCC applies to cannabis.

-

Someone within the state (any state but we will use Massachusetts) sues the local regulator seeking to overturn interstate restrictions (and easily wins).

-

East Coast operators board the ultimate big winner in this contest – JetBlue – and fly west to find a licensed supplier.

-

The product is purchased for medical use, tested to Massachusetts standards, and privately flown back to Massachusetts.

-

If the delivery is greeted by the FBI and DEA and the paperwork is clear and the use is medical, Rohrabacher will protect the shipment.

Low cost west-coast weed will be a boon for independent retail and product manufacturers, especially social equity teams who will have a lower-cost supply line to compete quite effectively with larger MSOs and deep-pocketed, fully-integrated operators who will continue to be locked into long-term, high-cost cultivation operations (with great admiration and respect, I disagree with industry stalwarts Shaleen Title and Andrew Kline, and the folks at Yale, who believe interstate commerce will be the death toll of social equity – I believe it will be the lifesaver – and I’m not alone – start a discussion with any east coast social equity cannabis aficionado who has contacts on the west coast).

When the largest MSOs find it difficult to remain current on their high-cost rent for their expensive indoor cultivation facilities, IIPR will be the lead canary in the cannabis coal mine.

Count on it.

Coincidently, my interstate commerce theory was once again explored on the April 15, 2022, episode (same day of the Green Market article that spurred this response) of The Green Rush, a weekly cannabis business talk show on ProCannabis Media. Industry consultant Jacques Santucci of Opus Consulting declared me to be crazy. We settled the matter with a bet as to who proves to be correct. You’ve seen the argument and have the list of names to research. Am I crazy? Hit me up and share your thoughts. Find me on LinkedIn at https://www.linkedin.com/in/davidrabinovitz/ or by email at DavidR@CannaVentureLabs.com or on Leafwire and let me know whether you believe I’m driving north and paying for Jacques’ Maine Lobster dinner or Jacques is coming to Boston and paying for chowder and Boston cream pie at Legal Seafood.

DAVID RABINOVITZ ON MASSACHUSETTS MARIJUANA, READ MORE...

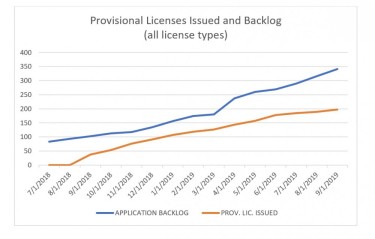

THE REAL NUMBERS BEHIND MASSACHUSETTS MARIJUANA LICENSING!