What Happens When The US Finally Reclassifies Marijuana?

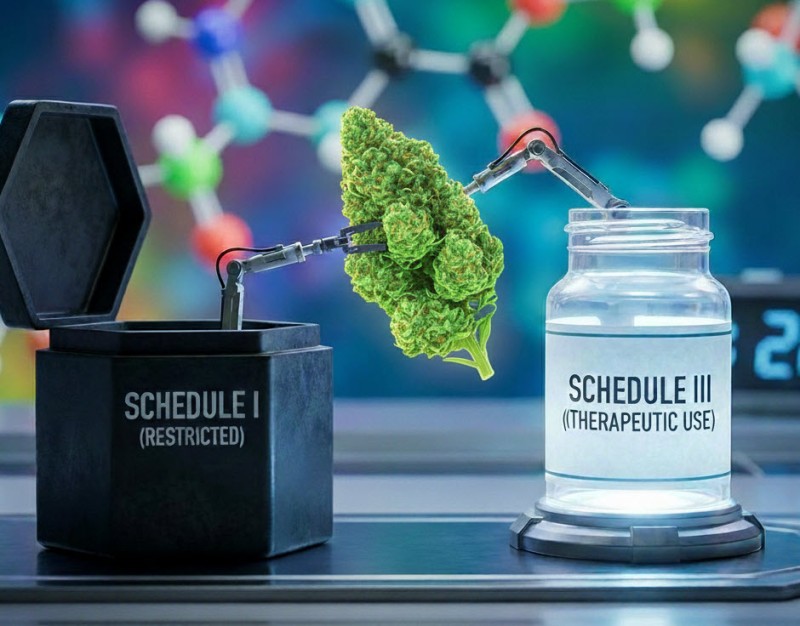

Since US President Trump just signed a historic executive order instructing federal agencies to finally move cannabis out of the harshest Schedule I category and move it into Schedule III of the Controlled Substances Act, there have been endless speculations about what may happen next for the future of weed.

Because weed was classified alongside LSD, heroin, and ecstasy in Schedule I, it was long treated by the federal government as a drug with no known medical uses and a high potential for abuse.

That said, we need to keep in mind that this historic and significant move doesn’t legalize weed just yet, nor will it automatically lift all kinds of federal restrictions. There are still a lot of moving parts that need to be set in motion, but here’s what we may be able to expect in the near future:

Pave the Way for Quality Medical Research

One of the most immediate ways we’ll experience the benefits of rescheduling cannabis is on medical and scientific research.

Keeping cannabis in the Schedule I category imposed massive regulatory barriers that made it difficult to study the plant, even for renowned and established clinical or scientific researchers. Strict DEA requirements and severely limited supply of cannabis that could be studied, were all major hurdles for researchers.

Once cannabis is successfully reclassified as a Schedule III substance, it would greatly ease these restrictions then allow researchers to study long-term health effects and therapeutic benefits. We can expect more new data coming out, especially when it comes to dosing, consumer guidelines, and product development to name a few.

On the same note, pharmaceutical companies and universities would also be able to delve deeper into the qualities of the plant, thanks to less logistical and legal obstacles that can help speed up new treatments.

After all, during the signing ceremony, Trump did mention that reclassifying weed may contribute to “tremendous amounts of research.”

Improved Medical Access, Possibilities for Insurance Coverage

Since cannabis is a Schedule I substance, the DEA treated it as a drug instead of medicine, and that had drastic effects on using the plant across various industries, including healthcare, insurance, and research.

Public and private insurers rely on the FDA approval to know if a treatment can be reimbursed or is legitimate. Clearly, Schedule I substances are blocked from the FDA pathways since they are, by definition of the federal government, non-medical in use. That’s why whole-plant cannabis medicine can’t be approved by the FDA, and in the eyes of insurers, it’s not a therapeutic drug.

In short, patients can’t claim insurance to pay for cannabis medications, even in cases where they are recommended by physicians and doctors. The same is true even if they are in a state where cannabis is legal on recreational and medical levels. The legality, or lack thereof, of a drug, will always override state medical programs,

With Trump signing the Executive Order, it can suggest an increased access for cannabis-derived drugs, especially CBD products. We may soon begin to see more proposals that can allow CBD and related treatments to be covered by providers such as Medicare, as long as they follow certain requirements that are yet to be determined.

Furthermore, rescheduling cannabis may also streamline pathways for the FDA approval of cannabis therapies, which may allow the integration of medical marijuana into more mainstream healthcare.

Tax and Financial Benefits

Even for cannabis businesses that operate legally under state law, they are still subject to numerous financial and tax issues since the drug is still illegal based on its Schedule I status. The biggest financial hurdle for them is the 280E, a federal tax law imposed by the Internal Revenue Service that means that weed businesses:

-

Can’t make deductions for expenses such as utilities, rent, payroll

-

Pay tax rates oftentimes over 60 to 80%

-

Must pay tax based on their gross income instead of net profit

This alone can cause cannabis businesses to fail by default, but that’s not the only tax and financial hurdle that they have to struggle with. Weed businesses also have limited access to credit and banking, exposing them to serious problems including theft and security risks, hefty fees from weed-friendly banks, no access to loans, and so much more.

Once cannabis is a Schedule III drug, it would mean the end of the 280E tax penalties. It would also signal improved cash flow and capital for cannabis businesses, making them much more attractive to investors. It’s unlikely that major banks will change the way they do business though some financial institutions may become more open to cannabis businesses over time.

What Won’t Change Yet

There are some things to keep in mind right now. Remember that recreational weed is still considered illegal, even with the executive order that Trump just signed.

State cannabis laws will also continue to follow their own rules, and states that have not legalized pot can still keep it illegal. Just because cannabis is being federally rescheduled doesn’t mean that it will override any local or state laws.

Interstate barriers will also still stay in place. Unless there is broader congressional action, there are serious legal risks and consequences that still apply when one crosses state lines carrying cannabis goods.

CONCLUSION

We are witnessing a meaningful, rare shift in the United States with the president’s signing of the Executive Order. This may signal that there is finally going to be some progress where it has long been needed, but we should not pretend that the work is finished. There’s so much more that needs to be done.

Yet, let’s relish the good news this holiday season since we’re experiencing something that the cannabis industry has not seen in decades: real momentum that is grounded in research, regulatory realities, and public health.

TRUMP RESCHEDULES CANNABIS, READ ON...

WHY RESCHEDULING IS A LOSS DRESSED UP AS WIN FOR THE WEED INDUSTRY