Insurance Companies Are Not Required To Cover Medical Marijuana, Federal Judge Rules

In a significant legal decision that could impact millions of Americans, a federal judge recently ruled that insurance companies are not obligated to cover the cost of medical marijuana, even when prescribed by a licensed physician.

This ruling exposes the complicated, often contradictory relationship between state-level legalization of cannabis and federal law, and it leaves many patients in a precarious situation: forced to either absorb the often high cost of their treatment or go without it altogether.

In this article, we’ll explore the full context of the case, why the judge ruled this way, the broader impact on patients, the legal complications surrounding marijuana, and what could happen next. We’ll also take a look at the growing conversation around medical marijuana and healthcare rights in the United States.

The Legal Tug-of-War Between State and Federal Law

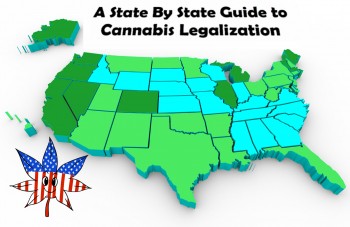

Over the past two decades, America has witnessed a dramatic shift in attitudes toward marijuana. What was once seen as an illegal and dangerous drug is now widely accepted for its medical benefits—and in many states, even for recreational use.

As of 2025, more than 40 states have legalized medical marijuana in some form. Conditions that qualify for cannabis prescriptions include chronic pain, epilepsy, PTSD, cancer-related symptoms, anxiety disorders, and many others. Doctors across these states routinely recommend marijuana to patients when conventional pharmaceuticals prove ineffective.

However, under federal law, marijuana remains classified as a Schedule I controlled substance—a category reserved for drugs considered to have a high potential for abuse and no accepted medical use. Other drugs in this category include heroin and LSD.

This federal classification creates a legal gray area. States allow it; the federal government does not. Insurance companies, which operate under both state and federal regulations, are caught in the middle.

This tension came to a head in the recent court case where patients tried to argue that their insurance plans should cover medical marijuana just like they would cover other doctor-prescribed medications.

The Case That Sparked the Ruling

The lawsuit was brought by several patients who suffered from serious medical conditions. They argued that their doctors had legally prescribed medical marijuana and that insurance companies should recognize marijuana as a legitimate form of treatment—just as they would cover opioids, antidepressants, or chemotherapy drugs.

The plaintiffs pointed out that many of them had exhausted traditional treatments and found medical marijuana to be the only effective option for their conditions. For some, it significantly reduced symptoms and improved quality of life where no other medication had succeeded.

However, insurers pushed back strongly. Their argument was simple: they cannot be required to pay for something that, under federal law, is still considered illegal. Covering marijuana, they claimed, could expose them to serious federal penalties, including accusations of funding an illegal activity.

The federal judge sided with the insurance companies.

Why the Judge Ruled Against Covering Medical Marijuana

The judge’s ruling was based on several key points:

-

Federal Law Takes Precedence

Despite state-level legalization, the judge emphasized that federal law remains supreme. As long as marijuana remains a Schedule I substance, businesses (including insurers) are not legally obligated—and may even be legally barred—from supporting its use.

This principle, known as the Supremacy Clause in the U.S. Constitution, ensures that when state and federal laws conflict, federal law wins.

-

Insurance Policies Must Follow Federal Guidelines

Most health insurance policies, especially those offered through employers or large companies, must comply with federal regulations, including those established by the Affordable Care Act, ERISA, and Medicare/Medicaid rules. None of these frameworks recognize marijuana as a covered treatment.

-

Financial and Legal Risk to Insurers

If an insurance company paid for marijuana treatment, it could potentially be accused of conspiracy to distribute an illegal substance or money laundering under federal statutes. The judge acknowledged that forcing insurers into this risky position was unreasonable.

The Real-World Impact on Patients

While the legal arguments make sense on paper, the ruling has real-world consequences—many of them painful.

For patients who rely on medical marijuana, the costs can be staggering. Depending on the state, the strain, and the method of consumption (oils, tinctures, edibles, or vaping products), medical marijuana can cost anywhere from $200 to $1000 per month.

Without insurance coverage, patients must pay entirely out-of-pocket—on top of other medical expenses like doctor’s visits, therapy sessions, or conventional prescriptions that insurance does cover.

For low-income patients, veterans, elderly individuals on fixed incomes, and those suffering from chronic illnesses, this financial burden can be devastating.

Some potential consequences include:

-

Patients cutting back on dosage or frequency of use.

-

Turning to cheaper, unregulated cannabis products (increasing health risks).

-

Skipping treatment altogether, resulting in worsening health conditions.

-

Increased reliance on opioids and other pharmaceuticals with higher risks of dependency and overdose.

Advocacy groups warn that these outcomes could lead to higher healthcare costs in the long term, as untreated or poorly managed illnesses require more intensive medical interventions down the road.

The Larger Legal and Political Context

This ruling is not just about insurance; it’s part of a larger national debate about how marijuana should be treated under the law.

-

Growing State-Level Support

Public support for marijuana legalization has never been higher. According to a Pew Research Center survey in 2024, about 88% of Americans believe marijuana should be legal for medical or recreational use.

Many states have responded by expanding their medical marijuana programs, offering financial assistance to patients, or even subsidizing cannabis for low-income residents.

Yet, without federal legalization or rescheduling, states’ efforts are always limited. Insurance companies, banks, and other businesses still operate under the shadow of federal prohibition.

-

Congressional Inaction

Several bills aimed at decriminalizing marijuana at the federal level have been introduced in Congress over the past decade, but few have made it into law. Most recently, the Marijuana Opportunity Reinvestment and Expungement (MORE) Act and the Cannabis Administration and Opportunity Act sought to remove marijuana from the Schedule I category and regulate it more like alcohol.

While there is bipartisan support for reform, political gridlock has repeatedly stalled progress.

Until Congress acts decisively, legal confusion will continue—and patients will continue to suffer.

Insurance Companies’ Point of View

It’s easy to blame insurers for refusing to cover medical marijuana, but from their perspective, the risks are very real.

Insurance is a highly regulated industry. Companies that step out of line—even unintentionally—can face massive fines, lawsuits, or even lose their licenses to operate.

By covering a federally illegal substance, an insurer could be seen as:

-

Violating money laundering laws.

-

Aiding and abetting drug trafficking.

-

Misusing federal healthcare dollars (especially in Medicare/Medicaid programs).

Until federal law changes, insurers argue, their hands are tied.

What Could Happen Next?

Several possible outcomes could shift the landscape over the coming years:

-

Federal Rescheduling of Marijuana

If the federal government reschedules marijuana (moving it from Schedule I to Schedule II or III), it could be recognized as having legitimate medical uses. This would pave the way for insurance coverage under existing healthcare laws.

In fact, the Department of Health and Human Services (HHS) recommended in late 2024 that the DEA consider rescheduling marijuana. A final decision could come soon.

-

New Federal Legislation

Congress could pass new laws to legalize, regulate, and tax marijuana—similar to the way alcohol is treated. If this happens, insurance coverage for medical marijuana would become much more likely.

-

State-Run Assistance Programs

Some states may create programs to help patients afford medical marijuana without relying on private insurance. These could be modeled after existing programs for low-income prescriptions or specialized treatments.

-

Expansion of Alternative Therapies

Pharmaceutical companies are also working on creating cannabis-based medications that are FDA-approved. Products like Epidiolex (for epilepsy) already exist. More such medications could be covered by insurance, offering a partial solution.

Conclusion

The federal judge’s ruling that insurance companies are not required to cover medical marijuana is a blow to millions of patients who rely on cannabis for relief from serious medical conditions.It highlights the urgent need for federal marijuana reform and a healthcare system that fully recognizes the evolving science around cannabis as medicine.

Until the law catches up with the reality on the ground, patients will be forced to bear the burden of expensive out-of-pocket costs—or worse, go without the treatment they need. The case serves as a stark reminder that while progress has been made in the battle to legalize and normalize medical marijuana, the fight is far from over.

For now, patients, advocates, and healthcare providers must continue to push for change—at both the state and federal levels—so that access to life-changing treatments does not depend on outdated laws or financial privilege.