Canadian Health Insurance Will Cover MMJ Starting March 1st

Canadian Health Insurance Covers Weed, Will US Insurance Cover It? from CannabisNet on Vimeo.

Soon in Canada, patients will be able to get as much as $6,000 of your MMJ subsidized by the government.

Before you start migrating to the Great White North, here’s the deets.

Sun Life Assurance Company is due to add MMJ as part of its group benefits come March 1. This is a major move for the health care industry, making Sun Life the first major Canadian insurance company to offer MMJ as optional coverage.

On a press release, Sun Life said: “Sun Life’s approach reflects current evidence-based clinical knowledge regarding the medical use of cannabis.”

“As this has become something our clients – being the individual companies known as plan sponsors – have been asking us about more and more, we have moved from the stage of evaluate and review, to now offering it as a benefit for medicinal purposes,” Sun Life senior VP of group benefits Dave Jones told The Globe and Mail.

Dean Connor, Sun Life’s chief executive, echoed Jones’ statement. “Medical marijuana has become a very important part of their treatment program and pain management program,” referring to patients suffering from chronic and terminal ailments.

Sun Life’s coverage for medical cannabis will range from $1,500 to as much as $6,000 per person annually. Currently, Sun Life already insures over 3 million citizens and their families, as well as more than 22,000 Canadian companies for the following conditions: multiple sclerosis, HIV/AIDS, cancer, rheumatoid arthritis, palliative care patients, and more. However, those who intend to add MMJ to their policy will be required to go through an approval process.

Sun Life’s move is timely, considering Canada is set to legalize recreational cannabis sometime later this year and the number of medical cannabis patients continues to grow. However, as early as 2016, Sun Life was already sending out feelers that they would be including MMJ in their coverage. According to the Financial Post, by the end of September 2017, Canada had over 235,000 MMJ patients recorded in the system, a significant increase from the 98,500 recorded just one year before, says Vahan Ajamian, a research analyst from Beacon Securities Ltd.

“The insurance companies have been getting pressure to cover this as regular medicine,” he added.

Sun Life will be conducting regular reviews, analyzing the increasing body of research on the therapeutic benefits of cannabis. If needed, Sun Life said they would be updating their criteria for other conditions.

According to Jonathan Zaid, who heads Canadians for Fair Access to Medical Marijuana, it took years of litigation for attitudes to change about MMJ. “Although there may not be immediate benefit for patients as specific plan sponsors will need to purchase the coverage, this move will make covering medical cannabis simpler than today’s exception process and speaks volumes to the broader acceptance and legitimacy of medical cannabis,” he says.

Prior to Sun Life’s move, most registered patients in Canada had to pay for their MMJ on their own. Hopefully, once March 1 comes, the change will inspire other insurers to move forward.

One of the toughest issues that health care faced with regards to covering MMJ was the fact that cannabis has long been without a Drug Identification Number (DIN). This number is crucial for health care plans, and this is why the MMJ coverage is only being used as an add on through the Medical Services and Equipment section of the plan. This means that cannabis will be treated in the same way as other reimbursements and expenses of the category.

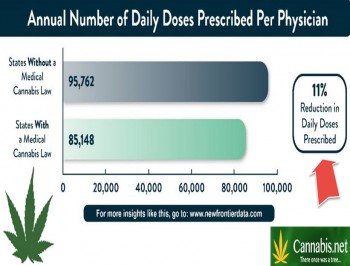

“We hope plan sponsors will see the positive benefits in medical cannabis coverage for their members and employees, including potential cost savings and substation of more harmful drugs, and include this type of coverage on their plan,” Zaid says.

As Sun Life’s plans roll out, we’ll eventually see how the major insurance player as well as others, will tackle certain concerns. Since these plans are covered by employers, we’ll also see if employee benefits will end up including MMJ, but thankfully these conversations are moving along quickly – at least in Canada. For other insurance companies, they may end up taking a wait-and-see approach to analyze how the legal recreational market will impact new insurance products.

OTHER STORIES YOU MAY ENJOY...

HEALTH INSURANCE WILL COVER MEDICAL MARIJUANA, NO? CLICK HERE.

OR..

CANADIAN HEALTH INSURANCE PLANS, CLICK HERE.