MJ BIZ recently reported that celebrity-endorsed cannabis brands like Houseplant by Seth Rogan and Khalifa Kush by Wiz Khalifa have the undeniable advantage of leveraging their vast fan bases and social media followers to capture consumer attention and generate excitement.

Wait a minute, I thought celebrity brands and co-branding by celebrities didn’t move the needle much on cannabis sales?

Previous articles on Cannabis.net like “Your Celebrity Branding Doesn’t Mean S#$%#”, or the Bloomberg news piece called “Celebrity Star Power Has So Far Had a Limited Impact on Cannabis Sales” both paint a different picture of the effectiveness of celebrity brands in weed.

What is going on then? Do celebrities bring enough juice to a brand to boost sales over time? Every customer survey done of cannabis buyers says that consumers care about three things, price, effect, and distance or time needed to get the product. Consumers don’t remember logos or colors or brand names, they do remember how much they paid, did the product work as expected, and how long or how much hassle was it to get said product.

Let’s dissect the MJ BIZ article to see if the headline matches the data.

It didn’t take long to get past the headline and find some “ah-ha” moments. To start:

A recent analysis of retail sales data from Headset indicates that these inherent qualities and other factors, such as promotional events and partnerships, significantly drive consumer purchases.

The first noticeable “asterisks” to the story, if you will, is that promotional events and partnerships SIGNIFICANLY drive consumer purchases of these brands. Reading between the lines means if Mike Tyson shows up at a dispensary or venue, his brand sells out that day. If Justin Bieber shows up to promote his pre-rolls at an event, the pre-rolls sell out that day. So having the celebrity actually there signing autographs and pushing his or her product is a big sales driver. Makes sense, but not repeatable on a daily basis with consumers. This is the Amazon Prime day example, when Amazon runs a 48-hour July special to get a massive consumer spending push. It pulls revenue from past and future sales for Amazon as consumers wait for Prime Day to buy something, or speed up a future purchase to get the discounts from Prime. It is a push-pull effect on sales, robbing Peter to pay Paul as they say.

Then the smoking gun pops up on consumer preference and celebrity branding. To whit:

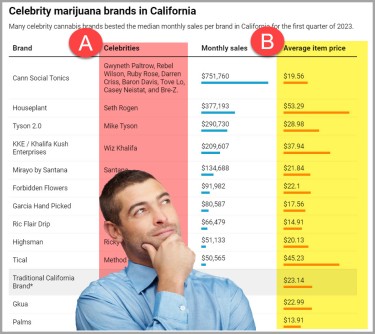

Interestingly, celebrity brands tend to offer lower price points than their traditional counterparts, with Headset data revealing that they charge less than the average of $23.14 per item set by traditional cannabis brands.

Hold the fort. That is data that is congruent to every consumer study and survey done in Canada or the US. Forget the word celebrity for a second, “brands that offer lower price points...get more sales”. So, are consumers buying celebrity brands or are they buying brands that offer lower price points? Past data says consumers care about price points very much, branding not so much. So, is this a cause of celebrity causation being confused with correlation? It is a common misconception in statistics gathering, causation and correlation, did something actually cause an effect or is it just correlated with the results you are looking at. In this case, it sure appears that celebrity branding is a correlation to consumer choosing the lower price point product, not a causation of why someone bought a product.

Did someone buy a Ric Flair Drip gummy because it was from Ric Flair or because it was 36% cheaper than the traditional, non-celebrity brand next to it on the shelf? ($14.91 vs. $23.14) If Ric Flair is at your dispensary that day promoting his product as mentioned above as an “event”, then it is a no-brainer what the 50-person line out the door is going to buy and get autographed that day. Again, a one-time event is not repeatable over time. If Ric Flair is not at the dispensary on a regular day, is the consumer buying X brand 10mg gummies for $14.91 or comparable product at $23.14? Data says the consumer will look at price point and effect first and foremost.

The MJ BIZ article reports that during the first three months of 2023, the study compared over 20 celebrity brands to a representative sample of more than 1,300 traditional marijuana brands.

So, comparing the top 20 celebrity brands to the entire field of 1,300 marijuana brands is a fair statistical parameter? Seems like someone is cooking the books to get the results they want from the survey. Why not do the top 20 celebrity brands vs. the top 20 or 40 traditional brands to make it a fair fight, or to get a statically accurate “apples to apples” comparison? I’ll take Backwoods vs any celebrity brand, let’s compare numbers. You want to have an educated discussion about branding in the cannabis industry, let's talk Cookies, not Justin Bieber's Peaches.

There are well known lists of “zombie” brands that have run out of money and don’t do any marketing in California. Keeping them in the data pool will certainly bring down the numbers of traditional brands and boost the “appeal” number of celebrity brands.

Comparing 20 celebrity brands to 1,300 traditional brands isn’t a fair comparison. Someone should have cut it to at least the top 50 selling traditional, non-celebrity brands, to get an accurate comparison on how much influence a celebrity really has on consumer choices in a dispensary.

In the first quarter, celebrity brands in the California market, including Cann, Houseplant, and Mirayo by Santana, outperformed traditional cannabis brands by a significant margin, as reported by Headset, a cannabis analytics provider based in Seattle.

Headset's findings indicate that traditional brands achieved an average monthly sales figure of $26,591. However, at least nine celebrity brands surpassed this figure, with five generating monthly revenues well above the $100,000 mark.

Again, would love to know the above sales number for just the top 50 traditional brands like Backwoods. What are we guessing that number jumps up to we eliminate 1,000 zombie brands in California? Well over the $100,000 mark just like the top 10 celebrity brands are doing I would bet.

The Celebrity Phenomenon in California's Marijuana Market

Cann, a popular marijuana beverage producer endorsed by Hollywood celebrities, influencers, and professional athletes, has far outperformed traditional cannabis brands by a staggering margin of almost 30-to-1.

This one is probably true because Cann is a carbonated infused beverage. High moats in that area, capital intensive to get started, tough for competitors to ramp up in that area. Is Cann super successful due to the celebrity part or just because they are “the only game in town” in that niche and well capitalized. Did the execute a successful business plan or get the right celebrity? I am going the latter.

Notable investors and brand ambassadors for Cann include actress Gwyneth Paltrow, entertainer and comedian Rebel Wilson, and former NBA player Baron Davis.

Mitchell Laferla, a data analyst at Headset, shared via email with MJBizDaily, "From my perspective, several celebrity-affiliated brands have achieved remarkable success compared to typical cannabis brands in California."

Are those several celebrity brands selling at a 36% discount to the market like Ric Flair Drips, as well? If so, that may help explain their “remarkable success”.

From a business standpoint, celebrity-endorsed brands have a unique advantage in opening doors and establishing connections with potential partners, enabling them to create distinctive promotions and foster meaningful customer interactions. Drew Punjabi, the brand manager of 22Red, a California cannabis lifestyle brand founded by entrepreneur and System of a Down bassist Shavo Odadjian, emphasized this point.

From the consumer perspective, the presence of celebrities in retail stores is highly sought after and plays a crucial role in driving engagement and, ultimately, sales, according to Punjabi. He highlighted the significance of influence in 2023, stating, "Celebrities possess that valuable connection with their fans and followers."

Ahhh, the presence of the actual celebrity in the retail store is a highly sought after thing and plays a crucial role in sales for that celebrity brand. Well, yeah, if Mike Tyson will be your budtender Monday to Friday, 8 to 5, you are going to sell a lot of Tyson Bites and his brand will sell very well.

"In an industry where physical, in-person retail sales remain paramount, having the ability to attract hundreds of people to a dispensary for meet-and-greets or events tied to product promotions or new releases is a massive advantage," Punjabi added.

Beating a dead horse now, game, set, match.

A New Approach to Celebrity-Backed Cannabis Brands

According to Headset, Los Angeles-based Cann has established itself as the dominant brand in celebrity endorsements, achieving impressive average monthly sales of $751,760 in California during the first quarter.

Early in its journey, the company partnered with Imaginary Ventures, a New York-based venture capital firm renowned for its successful contributions to Good American and Skims celebrity apparel brands.

Interestingly, Good American was co-founded by Khloé Kardashian, while Kim Kardashian founded Skims.

Rather than relying on celebrities already associated with cannabis, such as rapper Snoop Dogg or country music icon Willie Nelson, Cann opted for a different approach.

"We believed that if we could secure a mainstream celebrity who isn't typically associated with cannabis, we could revolutionize the conversation and normalize it in a fresh and impactful manner," explained Luke Anderson, co-founder of Cann.

"We successfully conveyed that cannabis is for everyone, not exclusively for those seeking an intense high."

Ahh, low dose cannabis beverages are very popular and a booming niche, agreed. Celebrity causation or correlation here?

Challenges of Sustaining a Celebrity Brand

Working with celebrities poses unique challenges beyond the typical obstacles faced by cannabis companies.

According to Black, one of the top challenges is overcoming consumer perceptions. These perceptions cover a wide range of factors, including product quality, brand authenticity and celebrity partnership authenticity, retail prices, and celebrity involvement in the company's operations.

Wait, consumers are questioning if celebrities are really involved in a brand or just sold their likeness and image to a brand for a quick buck? No way!

For Black, brand stewardship and the "do no harm" principal guide most of his decisions. He aims to preserve the 52-year legacy of Cheech and Chong without making any detrimental missteps.

Running a celebrity brand comes with immense pressure, with unexpected incidents, scandals, and the potential threat of "cancel culture" being significant concerns for operators in this space.

Last year, Tyson was involved in a physical altercation with an unruly passenger before Tress invested in Tyson 2.0. Despite the incident receiving national attention, Tyson's image remained largely unscathed, showcasing his enduring popularity.

However, despite the pull of celebrities, consumer awareness of celebrity-endorsed brands varies across different markets. According to Madeline Scanlon, cannabis insights manager at Brightfield Group, over 80% of California cannabis consumers are unaware of brands like Cann and Houseplant and their celebrity affiliations. This suggests that factors like product positioning, marketing strategies, and operational efficiency play a more significant role in achieving success, as Scanlon emphasizes.

Wowza! The headline of the article is celebrity brands are killing it because of celebrities! What does Madeline mean that most consumers are unaware of what celebrities promote what brands, but instead look at product placement, pricing, and how easy or hard it is to get the product. How dare she! That would be 100% the opposite of the article headline would leave you to believe.

Being a celebrity alone is not enough to succeed; a truly successful brand requires additional components beyond celebrity endorsement, Scanlon asserts. A celebrity brand's relevance often depends on the longevity and continued significance of the celebrity associated with it.

You mean no one under the age of 30 knows who Ric Flair or Cheech and Chong are right now? That could be a longevity problem for a brand, too.

This challenge is consistently faced by the executives behind Garcia's Hand Picked, which ranks No. 7 on the list with monthly sales of $80,587 in the first quarter.

The brand, a division of the vertically integrated company Holistic Industries, pays tribute to Jerry Garcia, the iconic frontman of the Grateful Dead and a symbol of counterculture. Garcia passed away from a heart attack in 1995.

Winning over Deadheads, a famously opinionated and anti-corporate community, is impossible. They demand high-quality cannabis flowers, unique strains, and a constant flow of new products, known as SKUs (stock-keeping units), according to Kyle Barich, the chief marketing officer at Holistic, based in Maryland.

"Much of my professional life involves catering to this challenging audience," Barich noted.

Recently, the brand wrapped up significant sponsorship at The Peach Music Festival in Scranton, Pennsylvania, where its logo was prominently displayed on signage and on one of the main stages. This marked a significant milestone for the company as it crossed into mainstream music events.

Ahhh, one time music festival push, got it.

Holistic takes responsibility seriously in the Grateful Dead realm and collaborates closely with the Garcia family trust and foundation on matters such as SKUs, merchandise, branding, marketing, and other business decisions.

"We are incredibly privileged to have the opportunity to honor the legacy of Jerry Garcia, whom we all deeply admire," Barich expressed enthusiastically.

Bottom Line

The headline highlights the significant impact of celebrity endorsements in the cannabis industry. By reading through the article the reality of the data supports what we already know and what consumers are saying in surveys. Celebrity brands have demonstrated their ability to attract consumer attention, drive sales at events the celebrity is at, and outperform traditional brands when every traditional brand is put in the data set, but is not a true comparison when you compare the top 20 celebrity brands to 1,300 non-celebrity brands. Leveraging the influence of celebrities, some brands have successfully navigated challenges, including consumer perceptions and market awareness. However, it is crucial to recognize that celebrity endorsement alone does not guarantee success, in fact, just the opposite. Additional factors such as product positioning, pricing, marketing strategies, and operational efficiency also play a vital role in achieving sustained growth and brand recognition. Celebrity brands must adapt and maintain relevance as the industry continues to evolve to ensure long-term success in this competitive landscape.