The Marijuana Taxation Problem - How Money-Hungry Politicians can Ruin a budding Industry

One of the big reasons why we want legal cannabis is because the unchecked black market has gotten way out of control. Don’t get me wrong, I’d much prefer zero government interference with the cannabis industry, however considering that prohibition created mega-cartels, a legal framework is needed to devaluate one of their most valuable crops.

The idea is to create a legal and safe alternative to black market weed. The Free legal market would have the resources and support available to create higher quality products at a more cost effective price point. Or at the very least match the black market price point.

This in turn would prompt consumers to rather go to a legal establishment that would divert funds from the black market into the pocket of the people. Through taxation, the money would then be diverted to create education campaigns and treatment facilities.

This way, you remove an element like “marijuana” from the streets, place it in a regulated environment that could help fund “education and treatment campaigns” for vices. It sounds swell on paper, but then Politicians got involved.

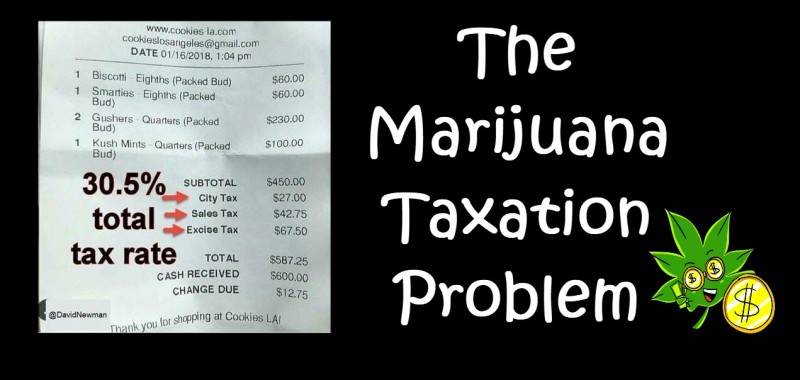

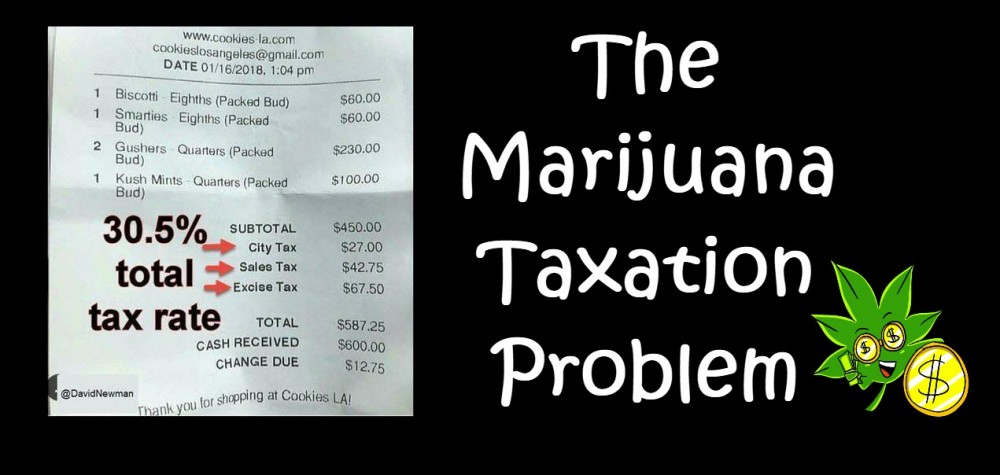

And what do politicians want? Well, money of course. They want to tax the hell out of weed and get a slice of that cheese. Which brings us to California, who recently legalized recreational cannabis.

The big problem was that they decided to tax the industry to oblivion. The state takes 40% of all retail dollars under the current taxing system.

This is because California also taxes the crops before they are even sold. Other states such as Alaska and Colorado sit between 10%-20% per sale. In some cases, California can have taxes as high as 80% if you include some Federal Taxes.

What this means is that the margin of profits are so small, that it almost becomes impossible to operate a legitimate cannabis business according to their rules.

In turn, consumers are simply going to a cheaper alternative. The streets. A lot of the weed on the streets in California matches the quality found in dispensaries. If you, the consumer is faced with the option to buy a baggy at 40% cheaper for the same quality…the choice is easy. Get more weed for less money.

Keep Taxes Low

The problem with placing high taxes on a fresh new crop is that it’s entirely short sighted. It’s trying to squeeze the money out of an industry that hasn’t had the opportunity to firmly place its roots yet. It’s thinking that this industry won’t last.

When you keep taxes low and rather focus on long term growth in the industry, you’ll be doing a service not only to the state, but the industry as well. Cannabis can bring in long-term gains and has the potential to sky rocket profits once its federally rescheduled.

The money-grab by politicians to tax the initial wave of cannabis commerce will only stifle growth and keep the money in the black market.

Fortunately, California is becoming aware of this problem and is thinking on slashing some of their ridiculous taxes. Why should the crop be taxed if corn isn’t taxed as a crop? Shouldn’t we be treating this commodity like we would any other?

The problem with cannabis is that there is still a lot of stigma surrounding the crop. The public demand for it and the legislative sluggishness in terms of implementing beneficial policies is stifling progress. The trick with legalizing cannabis is to give it time to grow. To allow it to establish itself in the marketplace and to watch your taxes grow over time.

Cannabis won’t ever be able to stop the massive debt each state has to work with. It will help with certain things, but it’s not something that will completely rid you of debt.

However, this also isn’t a reason to doubt the market. While it might not clear the debt, which in most states are poised in the billions, over time the revenue will make sense. It’s money that if not in a regulated system, would go back to cartels and other shady players.

Let California serve as a lesson

There have been several different approaches to legalization in the United States over the past few years. Let California’s blunder serve as a lesson on how not to legalize cannabis. I’m not saying that they got it all wrong, however over-taxation is death on a budding new industry and doesn’t deal with the underlying issue of black market weed.

In order for the Cartels to lose interest, taxes on cannabis should remain low for the next few years. In fact, there should be no incentive to increase taxes beyond the 15% marker. Of course, politicians will always try to work in more tax, however, if you want to legitimize a black market commodity, perhaps it’s best to keep it low so it can grow.

OTHER STORIES YOU WOULD ENJOY...

CANNABIS TAXES ON HIGHER THC IN CANADA, CLICK HERE.

OR...

SHOULD CANNABIS TAX REVENUE GO TO TOWNS THAT BAN DISPENSARIES, CLICK HERE.

OR..

45% CANNABIS TAX IN CALIFORNIA, SOME TOWNS, CLICK HERE.