Towns that Ban Dispensaries are Getting Cannabis Tax Revenue Checks

In what must be one of the most infuriating subjects to pro-cannabis legalization fans is the fact that towns that vote to ban dispensaries and cannabis businesses are getting checks in the mail from the state for cannabis tax revenue collected in other towns. We ran a story here at Cannabis.net on this issue which created a ton of social media anger and outrage. In a follow up discussion with a local town official here in Massachusetts, it is interesting debate and why do towns that have banned dispensaries allowed to get tax revenue from cannabis businesses.

SHOULD TOWNS GET TAX REVENUE THAT BAN CANNABIS, CLICK HERE.

The Old Testament DNA

One theory on the angst of cannabis fans seeing towns that ban cannabis businesses getting a piece of the pie if based in our very own DNA, or our “Old Testament” DNA. If you are not familiar with the Bible, the old Testament was the written Christian story before Jesus came to earth. The general rule was an “eye for an eye” and “a day’s pay for a day’s work”. There is something primal, something in our very fabric of right and wrong, that just knows that if you don’t allow the businesses you shouldn’t profit from it. If you didn’t earn it, you shouldn’t get it. It is “wrong” for a community that voted to ban marijuana to get tax revenue from marijuana, right? That is understood at some basic level of humanity, if you don’t want it, fine, that is your choice as a community, but to then get money from the tax revenue of the businesses you banned, well, that is just wrong.

An eye for an eye says you should not get the benefits from the things you voted to ban. A day’s pay for a day’s work is you get what you earn, and those towns that allowed cannabis businesses should get their fare share of cannabis taxes, but if you didn’t “work”, you don’t get the “pay”.

Why Not Just Shut Those Towns Out?

After doing some digging, two themes emerged as why we can’t just cut those towns out of the tax revenue created from marijuana. One, people not in the “fight for or against cannabis legalization” just don’t care enough to cut out those towns and do the required work necessary at the state treasurer’s office to figure out who gets checks and who does not, and what should those check amounts be without the missing towns included. Two, the example that is most closely used as a working example is the way the lottery system works, at least here in Massachusetts. There are some towns that ban or do not have a lottery terminal, meaning they created no sales into the lottery system, yet they get a check from the state for lottery tax revenue and income. The standard line is that it would be too complicated and expensive to figure out how to exclude a small percentage of towns or cities from the lottery revenue money. The same type of system exists now for cannabis tax revenue, but in Massachusetts a much higher percentage of towns voted for a ban or moratorium on cannabis in their town, the NIMBY excuse from conservative areas and towns. (Not In My Back Yard).

There is something inherently dishonest about banning cannabis businesses and then collecting revenue from those same businesses you banned. The ironic part is that most of the town that have banned cannabis or voted on a moratorium have neighboring towns that do allow dispensaries and cannabis businesses, so the idea that you will keep cannabis products out of your town by not allowing marijuana business is just a fallacy. What has happened is that people just must drive a longer distance to get their medicine or recreational cannabis, wasting gas (environment), wasting time, and creating jobs in neighboring towns.

One point of view mentioned was that towns that have homeless shelters and low income housing, but want to "protect the children" and ban cannabis, should not have tax revenue cut down because they feel they are doing the right thing. Why penalized the homeless in a town that voted to ban cannabis? I am not saying I agree, but I can see that moral stance as well.

Massachusetts is looking into whether these towns that voted on bans and moratoriums even had the legal right to make that vote as the option to ban businesses was not in the original marijuana legislation. The question on whether towns can legally ban such businesses is an ongoing matter in Massachusetts.

Is there a simple solution? Towns that vote against cannabis businesses shouldn’t get tax funds from cannabis. Pretty simple yet pretty hard to enforce it seems.

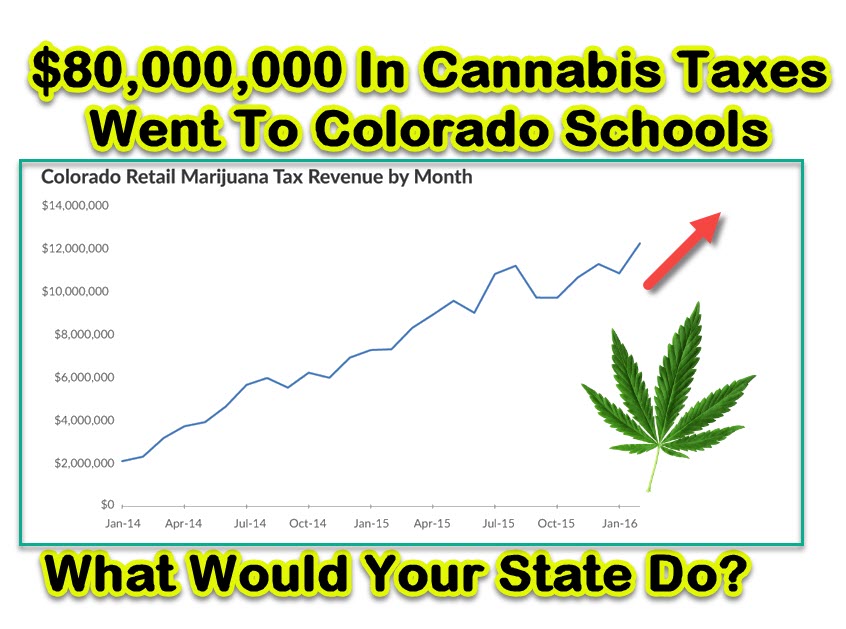

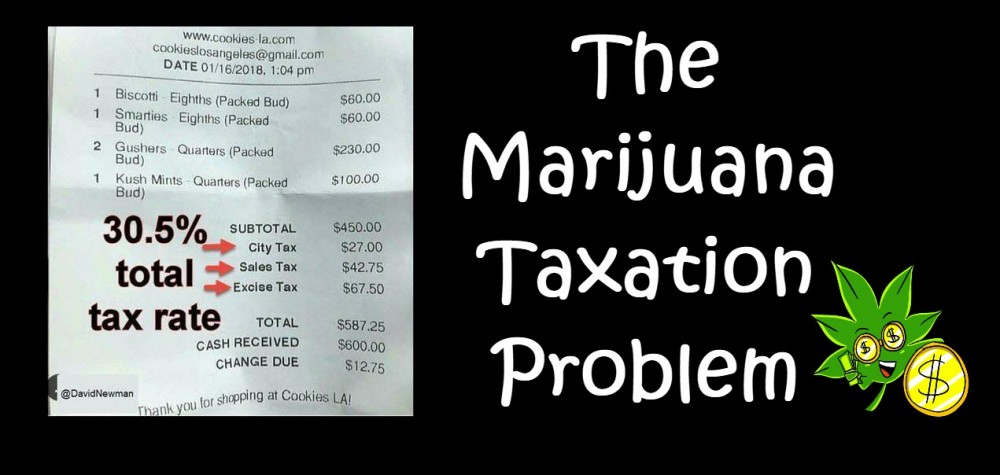

OTHER MARIJUANA TAX STORIES...

WHERE TO CANNABIS TAX REVENUES GO, CLICK HERE.