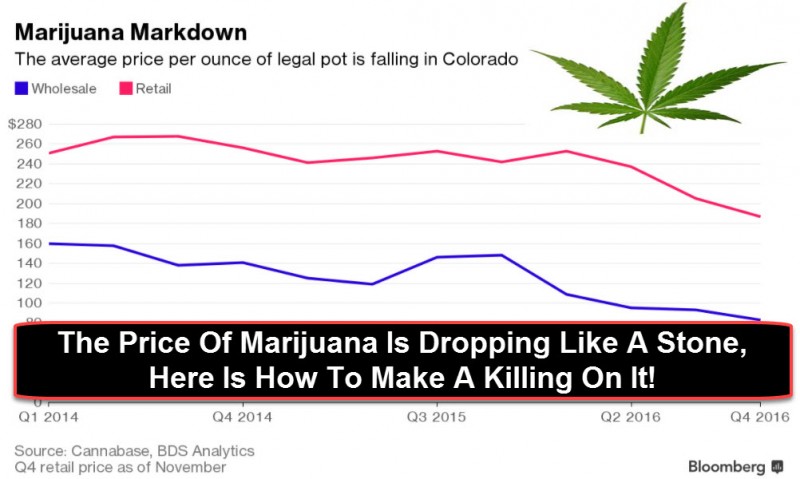

State of the Leaf: Legalization Makes Pot Cheaper

Pot lovers, we’re living in interesting times. Not only do more states have access to legal marijuana, but legalization is also making the stuff cheaper. This may be good news for consumers, but makes things a little hazy for the tax department.

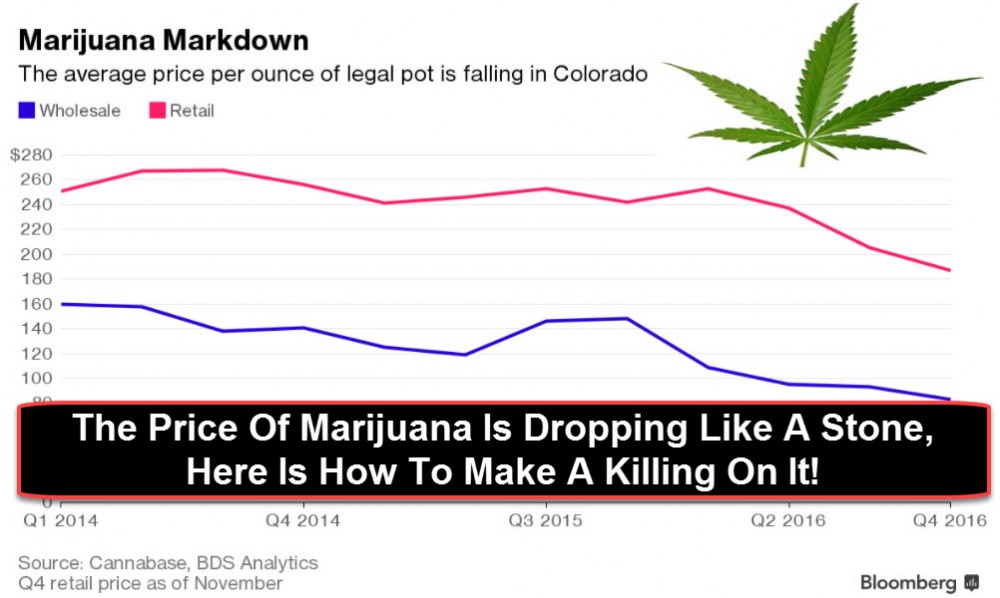

We hate to say "I told you so" here at Cannabis.Net but if you have followed our investment advice in this niche, (check this article and this one as well) you know we have been telling you this was going to happen and will continue to happen for years to come. It is a simple graph of supply and demand and some elasticity invovled.

So how can you turn that frown upside down and make a killing at the price of marijuana plummets? We will explain at the end of this article.

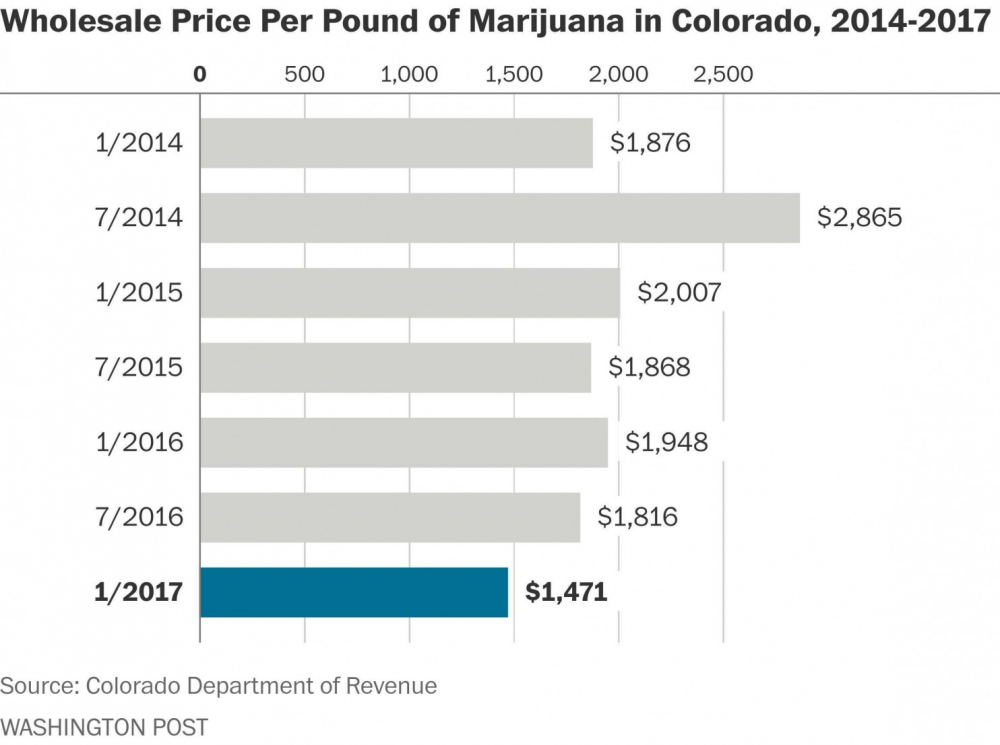

New data from the Colorado Department of Revenue says that wholesale marijuana prices have gone up in smoke, down by around 22% since 2012 when pot was first legalized. Wholesale prices are now around $1,471 per pound, which used to be $1,876. Before legalization, wholesale prices could reach as high as $5,000 per pound.

Many think that the price drops won’t be ending any time soon. According to Jon Caulkins, co-author of Marijuana Legalization: What Everyone Needs To Know, and drug policy expert at the Carnegie Mellon University, mass production of marijuana could eventually lead to prices going down as low as $30 per pound. The current price drops reflect the fact that since marijuana is still illegal federally and can’t be mass produced in most of the country. Marijuana Legalization: What Everyone Needs To Know co-author Mark Kleiman, who is also a drug policy expert at the Marron Institute at New York University, has always said that a joint of legal pot shouldn’t be costing more than a tea bag because at the end of the day, both contain just plants anyway. Once prohibition is no longer a burning issue and there are no more obstacles in marketing and business owners no longer have to fear getting raided, mass production will take effect and bring down the price of pot even more.

This is good news especially for patients since they’ll be able to have better access to affordable pot with less problems, but low pot prices is actually a double-edged sword for the tax department..

Keith Humphreys, drug policy expert at Stanford University, told the Washington Post that price drops will mean less tax revenue for states. In most states, marijuana is taxed as a percentage of its price, so clearly, lower wholesale prices mean less tax revenue. One way that states could work around this is by increasing pot use. However for Alaska and California, they don’t have to worry about this problem. In Alaska, pot is taxed at $50 per ounce no matter what the price is. In California, they have a grower tax and sales tax which is a flat amount per ounce.

Access to affordable pot will also mean that the black market will eventually crumble. Violent drug cartels who make most of their money from marijuana will no longer be in business, although this doesn’t mean the end of drug violence since they will have to look for other sources of income, like heroin and cocaine.

Safer Tax Payments In California

Due to the all-cash nature of the cannabis industry, safety remains an issue just like with cannabis retail businesses. Thanks to legalization, government offices in California can now expand so that cannabusiness owners can safely pay their taxes as well as state fees.

The Cannabis Safe Payment Act was written by 2 senators and backed by Fiona Ma, chairwoman of the Board of Equalization. The act would allow counties in California to accept payments from cannabis businesses for state bills, if tax collectors and individual boards of supervisors approve it. The Board of Equalization is granted permission to manage cash payments from cannabis businesses in 22 offices around California. However, most of their offices are in urban locations so some farmers and business owners will need to make a long trek while carrying cash.

“Driving around the state with bags of cash is not the safest method of paying your taxes, but it’s generally the only way the cannabis industry can pay what they owe until we can bank the industry,” says Ma in a statement. ““Our priority has to be increasing safety—for the business owner, the public, law enforcement, and state employees by enabling cannabis businesses to pay their taxes and fees in as many a safe and secure locations as possible.”

The Board of Equalization reported $50.5 million in tax payments from 1,023 cannabis sellers in June 2016. Since credit unions and banks don’t want to touch cash from marijuana businesses because of its federally illegal nature, the cash used by businesses for payroll, suppliers, and taxes make them a clear target for crime.

“While California can’t change the federal government's dysfunctional treatment of cannabis, we can work to ensure that our business owners here in California can easily and efficiently comply with our laws in a safe and efficient manner,” says Sen. Scott Wiener, D-San Francisco, who co-authored the bill.

So how does one profit from such a price drop in a commodity (which cannabis is quickly becoming) and make money?

You need to take the cannabis or marijuana flowers and turn them from a product to an expense. It is a shifting of the balance sheet. Wait, what are you talking about???

For example, let's look at the price of sugar around the world. Let's say the price of sugar drops 50% over 2 years. Is that good or bad? Well, if you are selling sugar it is very bad. If you are using sugar in your products, it is very good! Your margins and profits just expanded because one of your ingredients just became 50% cheaper. Countries like the Dominican Republic hate the sugar price going down since they export it, but Hershey's and Mars Corporation love it, since they use so much sugar in their chocolate.

So how does this apply to marijuana?

The price of cannabis dropping is very bad if you sell cannabis, but very good if you use cannabis as an ingredient in a product. Just like the sugar example above, people making oils, vape pens, and especially edibles just saw their profits go up, not down! If you want to take advantage of this price drop for the next 10 years, use cannabis as an ingredient, not as a standalone product. As we mentioned in our investment article above, edibles and oils are the future of cannabis, not flower. One dispensary owner actually thinks there may come a day where they will give away an 1/8 of flower just to get you to come in and buy edibles and oils.

OTHER STORIES YOU MAY ENJOY...

INVESTING IN MARIJUANA, TO TOUCH THE FLOWER OR NOT, CLICK HERE

OR..

CAN MARIJUANA STOCKS MAKE YOU RICH, CLICK HERE.