Is Weedmaps’ $1.5 Billion Valuation the Canary in the Coalmine for the Entire Marijuana Industry?

Will the Weedmaps IPO lead to a major shift in value for the cannabis industry?

There have been some big deals done in the cannabis space, most notably Bruce Linton, while CEO at Canopy Growth, raising $4 billion in a deal with Constellation Brands. That was a deal involving the biggest weed-growing player in a country where marijuana is Federally legal. Now, shockwaves are being felt around the cannabis industry as one of the largest cannabis websites in the industry, Weedmaps, has decided to go public in the Silver Spike Acquisition Corp SPAC fund at a whopping $1.5 billion valuation.

Wait, how on God’s green earth does a website not legally selling weed yet (wink, wink) get a $1.5 billion dollar valuation? That is a lot of dinero from dispensary listings and menus, no?

According to their press release:

WM Holding Co. “has grown revenue at a CAGR of 40% over the last five years and is on track to deliver $160 million in revenue and $35 million in EBITDA for 2020.

The business created at least $439 million in revenue from 2015 through 2019, according to U.S. Securities and Exchange Commission filings.

It is expecting $160 million in revenue this year and estimates that revenues in 2021 will hit $205 million.

Wait, read that again.

A cannabis website, with weed being Federally illegal in the US, and only 10 to 14 states having a medical program between 2015 and 2019, brought in $439,000,000 in advertising fees?

$439,000,000 in cannabis-based revenue between 2015 and 2019 would make Weedmaps the most successful cannabis company in the history of the earth, and according to them, they didn’t actually sell any weed in that $439,000,000. So, 20 legal states with dispensaries created close to half a billion dollars in ad sales for Weedmaps? Say what? They are expecting $205,000,000 in revenue this year from ad sales and software sales, none of that money includes any direct cannabis sales they claim.

Canary in the Coalmine for the Old Cannabis Industry

It is hard to say the cannabis industry is “old”, but like computers and their half-lives, time flies in marijuana years. The old industry built legal moats around state-rights, and THC not being able to cross a state line or able to use any legal shipping or post service. What is the Weedmaps valuation, and Leafly for that matter as the rumor is they are looking for a similar deal from another SPAC fund symbol GNRS, once the MORE ACT or some form of federal legalization kicks in and they can actually sell and ship cannabis directly from their website and app? They are going to do $210,000,000 in revenue this year based on Google rank and internet traffic WITHOUT selling any weed!

That is devastating to the current cannabis model of investing and setting up a “state-oriented” cannabis business. The industry must pivot quicky and see the future of cannabis is a Shopify game, with Internet traffic winning the orders. The state-by-state set up will be obsolete as some form of THC-crossing state lines will be legalized for market efficiencies. Once that is allowed, and our guess is that state-licensed retailers in good standing with their state will be grandfathered in for some national selling program, the current model of brick-and-mortar dispensaries falls apart overnight. Expensive licenses, $20 million buildouts, lawyers, aggressive landlords, poof, gone overnight.

Think it won’t happen? Ever order wine or booze over the internet and have it delivered from another state? How about liquor delivered to your door "in-state" through an app like Drizzly? The backend store will not matter, it is the product you want delivered that matters. You do not care if your 6-pack of Bud came from Joe’s Liquor or Costco, as long as it gets to you in a time frame you expect and at a cost you agree to.

Assuming Leafly, which is backed by Peter Thiel and the Tilray Empire, gets something close to a billion-dollar valuation, you will be looking at the two biggest weed websites online getting billion dollar valuation, and they haven’t even sold a gram of weed, yet, officially. Their valuations could be 100x higher if they are the dominant online cannabis sellers around the world, it would be the big 2 and Amazon as your cannabis retail price check sites.

Can Anyone Catch Weedmaps?

This is literally the billion-dollar question, is it possible to even catch Weedmaps after a strong 20 years of Google content and close to half a billion in revenue over the past 5 years to build up their internet moats and traffic?

Is it possible? Yes, but with some caveats. As I wrote here about “What I Would Do with $100 Million Right Now in the Cannabis Industry”, it will require consolidation from smaller players, as even Leafly isn’t big enough to do it alone. One problem is that if Weedmaps gets $500 million of paper and cash to play with, they can go out and buy up smaller competitors before other major players get involved, thus fortifying their already strong internet position.

There are a few asterisks to read through on the Weedmaps’ public filings, the biggest being the ongoing subpoenas and investigation from the Justice Department. One of Weedmaps’ biggest mistakes was thumbing their nose at the California Cannabis Commission when they asked them to remove all non-licensed cannabis providers from their listings and website. Weedmaps said no and said they were protected by the same free speech and content creation laws that protect Facebook and other social media sites. California’s AG then walked down the hall and got the Feds involved and that is a long and expensive process that Weedmaps is now embarked on, answering, and filing all paperwork requests from the Federal government. Weedmaps obviously has the money to pay their lawyers and to cut a deal if the government isn’t out for blood. It will be a body blow but nothing fatal, and the money from whatever fine comes will be made up easily with direct cannabis sales and/or Federal legalization.

The worst-case scenario is that the government is out for blood, taking money from sellers of a Federally illegal drug and profiting form it puts you in a world of trouble as far as criminal activity (think Silk Road Saga), RICO Act violations, money laundering, mandatory sentencing, and criminal-intent laws. You could see an extreme crack down, or example-setting, by the US government taking control of the Weedmaps URL and shutting the site down for all intent and purposes like they did with the Silk Road site. Calfornia law estimates that Weedmaps could be on the hook for $6.2 billion in fines.

This is a tough one to call unless you are in the Justice Department and know what the US government is looking to do in a case like this. Are you looking for a major fine and some wrist slapping for the C-Suite, or are you looking at 20 years of blatant Federal drug trafficing charges and money laundering violations? One thing going against Weedmaps right now is that there have been a series of high-profile marijuana busts in the past 2 years where clients of Weedmaps were busted for having illegal marijuana setups going and using Weedmaps as a funnel for their business. Laptops and desktops seized by the Feds in those raids, and cooperation form those parties arrested, may determine the fate of what the Federal government decides to do with Weedmaps in general.

If the Weedmaps site was taken over by the US government, Leafly would be the dominate player and the world of cannabis mapping and menu management would be more competitive as smaller players could carve out space and revenue in that space.

Either way, the precedent is being set for a value on internet traffic from people who want to buy weed, and those valuations are ridiculously high, or are they? Half a billion dollars in revenue by listing menus and locations may just be the tip of the iceberg of what these sites can be worth by selling weed directly to consumers? Do you think Amazon isn’t paying attention to some of the valuations now being put on weed traffic online?

Selling advertising is great, but selling weed to the entire world with 80% margins could be explosive.

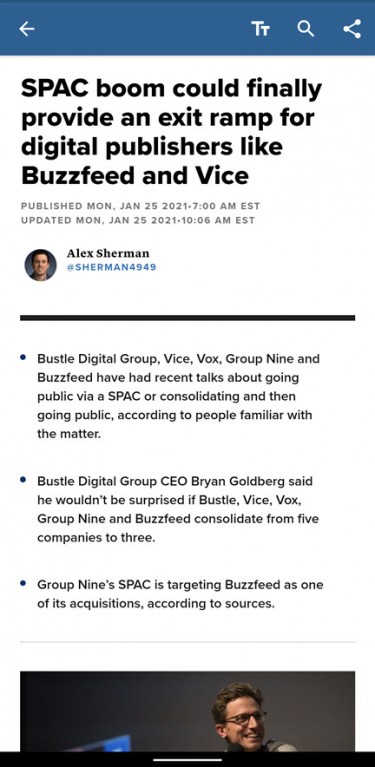

1/25/2021 Update

Looks like non-cannabis media and digital platforms are using SPACs now, too.

CANNABIS INVESTING FOR THE FUTURE, READ MORE...

WHERE TO PUT $100 MILLION IN CANNABIS RIGHT NOW!

OR..

THE FEDS GO AFTER WEEDAMPS AND 30 OTHER CALIFORNIA COMPANIES!

OR..

WEEDMAPS, AND THE ENTIRE CANANBIS INDUSTRY, HAS A BIG PROBLEM!