If I Ran a $100 Million Cannabis Investment Fund This is Exactly What I Would Do Right Now

If you got $50 or $100 million to invest in cannabis, what would you do right now?

Dare to dream.

If you had a $50 or $100 million SPAC or investment fund that wanted to invest in cannabis what would you do right now? The Presidency, House, and Senate are all Democratic come January 20th, with the assumption being that Federal marijuana legalization in some form or another is just around the corner. The article I wrote here “Marijuana Legalization Imminent Worldwide in 2021 Now” got some interesting comments on different social platforms, one of which, was “What would you do now to invest?”.

There are a few caveats to get out of the way first. The assumption of that past article is that we will see cannabis legalization at the Federal level in 2021, most likely the MORE ACT. This will remove cannabis and THC from the Controlled Substance Act, hence making it legal to ship marijuana across a state line, mail it through the Post Office and Fed Ex, and remove any oversight that the DEA or FBI would have over the plant. This will lead to the UN changing their drug policies for 163 member countries, now allowing all members to legally enter the cannabis industry without fear of US financial retribution. That means countries with much lower labor, electricity, and water costs will be entering the marijuana growing space and will be shipping lower cost cannabis around the world.

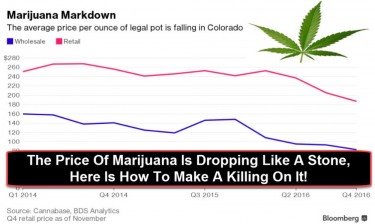

The general theme is that if Oregon and Canada were any type of test experiments, we are going to see massive oversupply in the legal, and certainly the illegal markets, hence, compressing margins in first world countries like the US and Canada. So how can you make money? Remember our article about when the price of cannabis the flower drops, how do you make money? Turn that plant flower into an ingredient and make a higher priced, higher margin product like an edible or oil. Think about what Hershey’s does with the commodity called sugar, they take a commodity, make it an ingredient in a higher priced, higher margin product, and then sell it. Cannabis is a commodity, it is a plant that grows in 12 to 16 weeks, indoors or outdoors, eventually it will be traded on with Future’s contracts just like sugar, lima beans, corn, flower, and coffee. My guess is that there will be three levels of quality traded in the future’s market, medical, recreational, and schwag, but I digress.

Since there will be massive compression at the bottom line and since there are only so many ways to skin a cat after Josh Haupt’s “3 pounds a light” standard. Yes, new lights will increase yield by X % in the future, new soil mixtures will help increase plants size by X %, but in the end, with a fixed cost of labor, water, and electricity, there is only so much blood you can get from a stone on the bottom line.

In the end, cannabis will just be a Shopify game, whoever can drive the most traffic to a web-based store, or brick-and-mortal store, and who can convert that traffic to a customer at the best rates will be the winners. Millions of webmasters will be shopping their network traffic to cannabis sites that offer the best affiliate programs. Those stores with the best affiliate payouts will win the traffic in 9 out of 10 cases.

So where can find margin and profit without moving all your grow and supply to places like Mexico, Haiti, and Guatemala? Look to top line for things like cost per order, cost per customer acquisition, and customer retention goals. It costs a lot less to keep a happy customer then trying to find a new one, so rewards programs like Amazon Prime and Chase Sapphire Preferred will be one key to winning the cannabis consumer long term.

How Would You Invest $50 or $100 Million Right Now?

If I oversaw a cannabis SPAC fund or investment fund, I would do two main things, buy up cheap cannabis licenses in low-cost states as a way to CYA, or cover you’re a$$, as we move toward Federal legalization. Some states are awfully expensive and time-consuming to get a marijuana license, but others are not nearly as cumbersome, such as Colorado, Oregon, Maine, and Oklahoma. Believe it or not, you can get retail licenses in 5 or so states for less than $1 million, gross, not each one. That gives you a solid platform to sell cannabis in those states, and either start to ship it across state lines when the coast is clear, or at least ship it within those state lines for a while.

So, what would I do with the other $49 million?

Drive traffic to those licenses and create a lean, or mini-MSO, for $0.05 on the dollar from whatever everyone else paid over the last 4 to 5 years. So, you have your 4 to 6 state licenses, which will almost certainly be honored in some form or another with Federal legalization, and now you just need to create the most orders for those licenses and locations. If you decide to ship and send orders to legal recreational states through the mail, at least you have licenses to sell retail and such to fall back on and qualify for whatever the future rules are for shipping and selling cannabis just as if it were a TV, a pair of shoes, or cases of Monster Energy drinks.

Then comes the fun part, buy up the Internet.

Buy up cannabis websites have a strong history with Google, high traffic, and create a moat where you control anywhere from 15 million to 30 million unique cannabis visitors per month in your Internet network. Those 15 to 30 million unique eyeballs have a wallet and can be converted to customers with the right offers and marketing magic.

Who Can You Buy Up and Who Will Be a Problem?

The first rule to look at is DA, or Domain Authority, for a buying a website. The domain authority rank is the 50,000 foot look at what sites’ power or reputation is in the eyes of Google, Bing, DMOZ, and other mapmakers of the Internet. The higher the DA, the higher ranking you can expect articles and videos to rank in search engines, while not a perfect science, it gives you a good idea of the health and history of a site or domain.

Second, you want to look at history, the older the website or URL, the better. When was it registered and how long ago did it start indexing content?

Third is traffic. How much does the site currently have and how much could it get with better on-page content or off-page link building? Are you starting with a Ferrari or are you taking an old VW and putting in a new engine and giving it a new paint job? Is the site also actively doing videos for YouTube and Vimeo? Is the site currently working with social media platforms or could their presence be improved?

Wait, why do I need to buy internet properties if Google and Facebook will just allow pay-per-click advertising in the future? Isn’t it better to just pay per user and have a much better visibility where every ad dollar is going?

No. Remember we are talking about margin and margin compression. Even if you want to get into a battle of $35 per click for “ounce of Blue Dream” in Adwords, every order or user you bring in organically lowers your customer acquisition cost by a half or more.

Let say you and Canopy or Curaleaf both bid $35 for the top spot for the search results of “buy blue dream” and you each get a click. For the sake of this example, let just say both clicks turn into an order for both of you. At the same time, since you have tons of organic traffic through Google, you get an new visitor to optin to a box to buy your Blue Dream special that day. The optin lead cost $0.01 or less since you already rank well in Google for all your weed articles. Now Curaleaf paid $35 for that order of Blue Dream to come in and you paid $17.50 that minute for the order since you got two orders in at once, one from organic traffic and one from Adwords. Yes, Adwords is more precise than SEO spends and ranking, but for every organic user you convert to an order you lower your cost-per-acquisition costs.

In the end if Cualeaf, is paying $3,500 in Adwords for 100 clicks and you are paying the same, but also getting 100 organic traffic orders, their cost per order is $35 and yours is $17.50. The more organic “found money” you create, the lower your cost-per-order, the higher your margins. You can only mess around with the bottom line with lights and soil so much, but the top line has plenty of margin room.

Who Could You Buy?

Weedmaps – The King of Kings Just agreed to go public in a SPAC fund at a $1.5 billion valuation, unless you have some very deep pockets, they are probably out. While sporting an impressive $160 million in revenue, subpoenas, and on-going investigations by the Justice Department loom over their heads as they head public.

Leafly – Part of the Peter Theil/Tilray Empire, a site that has been around over 20 years and has gotten over $40 million in funding. Leafly can be an order-feeder for Tilray dispensaries around North America. Probably not for sale, and if so, would command a valuation in the ballpark of Weedmaps, but to the low side.

Marijuana Business Daily – The Wall Street Journal of the Cannabis industry and a fantastic group set up by CEO, Chris Walsh. A great web profile and took a major hit with their Las Vegas shows cancelled the last two years. Would you want to own the Washington Post of cannabis and turn those readers into buyers? Interesting and may be willing to listen….

Cannabis.net – Lean and mean, been in stealth mode for awhile waiting for legalization. A major ramp up in on-site structure and backend speed has taken their one weakness and turned it into a major advantage, site speed. Traffic and rank have climbed steadily over the past few month and because of their high domain authority and “exact match” domain for the word cannabis, the sky is the limit on developments in the future. Weedmaps, or the Ghost Group, LLC, owns the only other 3 exact-match domains in the industry, such as Marijuana.com and .net, and recently buying Cannabis.com for millions.

High Times – The fabled brand has gone for a tumble over the past years with the takeover by Overa Capital and Adam Levin. Having burned through C-Suite executives and tons of cash, High Times embarked on an ill-fated crowdfunding campaign and soon found themselves on the wrong side of the SEC and a variety of pending lawsuits. While there is still some value in their brand and Internet site, the baggage that comes along with this deal with be daunting to say the least.

Leafwire – The LinkedIn of Weed lead by Peter Vogel has done an excellent job of building up a solid website with traffic. Currently in a crowdfunding campaign as well, an early and exciting site that could be developed into a mega-giant based on the early work done by Peter and his team. Since he is raising money now, I am sure he would take a call about a sale.

Merry Jane – Part of Snoop Dogg’s cannabis empire lead by Karan Wadhera and Casa Verde Capital. Since they just completed a $100 million raise, the Dogg is in the accumulation mode, not the selling mode as cannabis legalized, so most likely not for sale.

The Fresh Toast – Lead by media rock star, JJ McKay, this site has blossomed from a millennial-based trends and celebrity news to a full-blown cannabis powerhouse. With partnerships in the medical and syndication arenas traffic continues to boom, and yes, JJ would listen to offers if the price is right.

Herb.co – A millennial-based social media powerhouse, their website has undergone quite a few facelifts and changes over the past three years. Since they raised over $5 million already, their web rank and links are solid, and their social media game is top notch in the niche. With $5 million raised already, there will be a few mouths to feed on a buy out and prices may get steep quickly, but the site could be in play at the right price.

Marijuana Moment – The grassroots cannabis news site lead by Tom Angel runs online ads and asks for donations to keep the doors open. While some in the industry will bristle at their run-ins with Tom and his staff, the truth remains, it is a well put together site with a good Internet profile. With the right vision it could be a monster in the future, and since donations are encourages, Tom may be open to a funding or sale conversation.

The reason that Weedmaps is so valuable, and prices out at an astronomically high $1.5 billion, is that they are already implementing this vision and getting ready to get bigger and better with access to the public markets. Do not be surprised to see them buy up competitors in this exact model to increase their ever expanding “moat” of web rank and traffic. While no one in the industry can touch their recently disclosed revenue numbers, to make a run at the champs, someone will need to consolidate a decent number of sites and traffic to be a viable threat to the online empire they are building.

For less than $50 million you could build a revenue generating “Amazon of Weed” that could sell legally in a minimum of 4 to 6 states day number #1, and best-case senior could be shipping cannabis to over 15,000,000 to 30,000,000 unique viewers per month.

We are going to need a bigger boat.

WHAT IS NEXT FOR WORLDWIDE WEED, READ MORE...

IS WEEDMAPS' $1.5 BILLION VALUATION THE CANARY IN THE COALMINE?

OR..

CANNABIS LEGALIZED NOW IN 2021, YOU BET, THANKS GEORGIA!