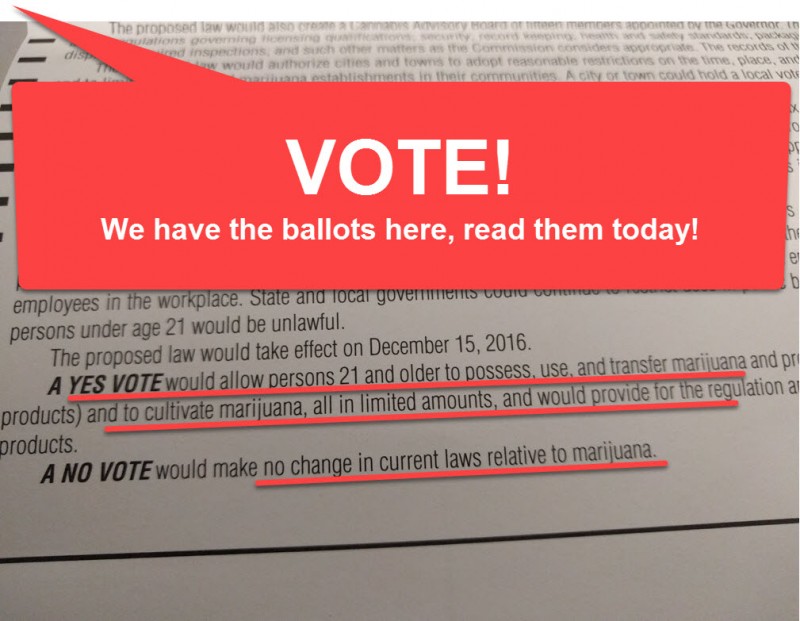

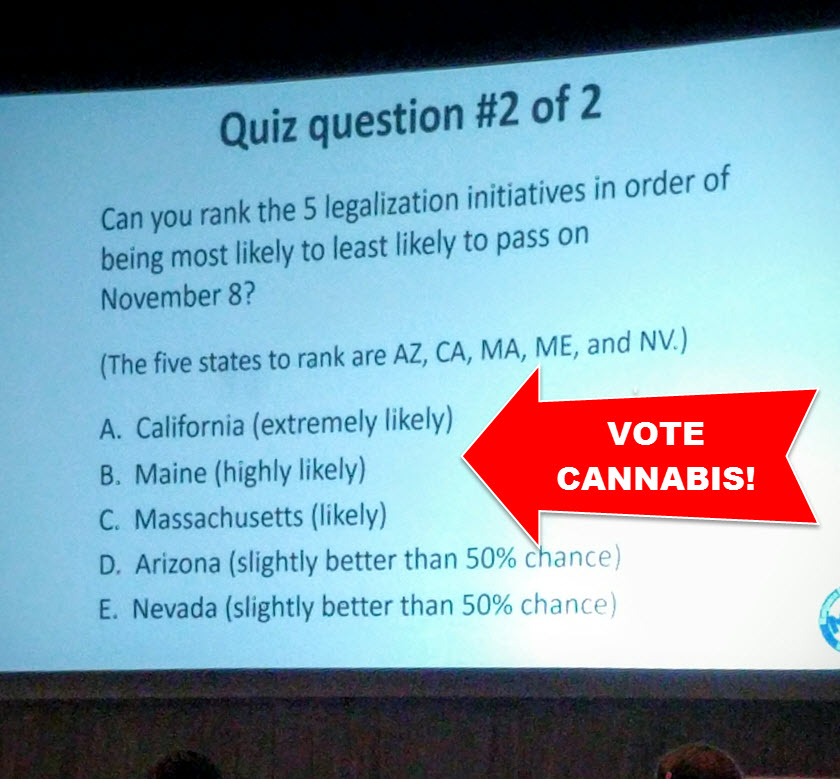

Get ready to vote for legal cannabis! Get a sneak peak at all the ballots before you walk in! All information is taken from a great site called Ballotpedia, which you can check out by clicking here.

Massachusetts

|

|

Maine

|

This initiated bill allows the possession and use of marijuana by a person 21 years of age or older. It provides for the licensure of retail marijuana facilities including retail marijuana cultivation facilities, retail marijuana products manufacturing facilities, retail marijuana testing facilities and retail marijuana stores. It also provides for the licensure of retail marijuana social clubs where retail marijuana products may be sold to consumers for consumption on the licensed premises. It provides for regulation and control of the cultivation, manufacture, distribution and sale of marijuana by the Department of Agriculture, Conservation and Forestry. It allows the department to establish limitations on retail marijuana cultivation. It allows a municipality to regulate the number of retail marijuana stores and the location and operation of retail marijuana establishments and to prohibit the operation of retail marijuana establishments in the municipality. It also allows a municipality to require separate local licensing of retail marijuana establishments. The initiated bill allows a person 21 years of age or older to use, possess or transport marijuana accessories and up to 2 1/2 ounces of prepared marijuana; transfer or furnish, without remuneration, up to 2 1/2 ounces of marijuana and up to 6 immature plants or seedlings to a person who is 21 years of age or older; possess, grow, cultivate, process or transport up to 6 flowering marijuana plants, 12 immature marijuana plants and unlimited seedlings, and possess all the marijuana produced by the marijuana plants at that person's residence; purchase up to 2 1/2 ounces of marijuana and marijuana accessories from a retail marijuana store; and purchase up to 12 marijuana seedlings or immature marijuana plants from a retail marijuana cultivator. It allows the home cultivation of marijuana for personal use of up to 6 flowering marijuana plants by a person 21 years of age or older. The initiated bill allows a person to consume marijuana in a nonpublic place including a private residence. It provides that the prohibitions and limitations on smoking tobacco products in specified areas as provided by law apply to smoking marijuana and that a person who smokes marijuana in a public place other than as governed by law commits a civil violation for which a fine of not more than $100 may be adjudged. The initiated bill places a sales tax of 10% on retail marijuana and retail marijuana products.[10] |

” |

California

Ballot summary

The long-form ballot summary is as follows:[9]

|

“ |

|

” |

The shorter ballot label summary is as follows:[9]

|

“ |

Legalizes marijuana under state law, for use by adults 21 or older. Imposes state taxes on sales and cultivation. Provides for industry licensing and establishes standards for marijuana products. Allows local regulation and taxation. Fiscal Impact: Additional tax revenues ranging from high hundreds of millions of dollars to over $1 billion annually, mostly dedicated to specific purposes. Reduced criminal justice costs of tens of millions of dollars annually.[16] |

” |

Petition summary

The long-form, official ballot summary for Proposition 64 was changed from the initial summary provided to initiative proponents for the purpose of circulating the initiative for signature collection. The original summary provided for inclusion on signature petition sheets was:[15]

|

“ |

Legalizes marijuana and hemp under state law. Designates state agencies to license and regulate marijuana industry. Imposes state excise tax on retail sales of marijuana equal to 15% of sales price, and state cultivation taxes on marijuana of $9.25 per ounce of flowers and $2.75 per ounce of leaves. Exempts medical marijuana from some taxation. Establishes packaging, labeling, advertising, and marketing standards and restrictions for marijuana products. Allows local regulation and taxation of marijuana. Prohibits marketing and advertising marijuana to minors. Authorizes resentencing and destruction of records for prior marijuana convictions.[16] |

” |

Arizona

|

“ |

ALLOWS INDIVIDUALS TO POSSESS, GROW AND PURCHASE MARIJUANA FROM STATE-LICENSED FACILITIES FOR PERSONAL USE. A “yes” vote shall have the effect of permitting individuals 21 years and older to privately use, possess, manufacture, give away, or transport up to 1 ounce of marijuana and grow up to 6 marijuana plants at the individual’s residence; generally declaring violations of the Act (including public use) a petty offense punishable by no more than a $300 fine; creating the Department of Marijuana Licenses and Control, which includes a 7-member Marijuana Commission appointed by the Governor, to regulate and license entities involved in cultivating, manufacturing, distributing, selling, and testing marijuana products; granting local jurisdictions limited authority to enact ordinances and rules to regulate marijuana and marijuana products; establishing licensing fees for marijuana establishments and levying a 15% tax on all marijuana and marijuana products; and declaring all marijuana establishment contracts enforceable notwithstanding any conflict with federal law. A “no” vote shall have the effect of retaining existing law, which prohibits individuals from using, possessing, growing or purchasing marijuana unless the individual is authorized by and doing so in compliance with the Arizona Medical Marijuana Act.[5] |

” |

Ballot summary

The ballot summary is as follows:[3]

|

“ |

The Regulation and Taxation of Marijuana Act: (1) establishes a 15% tax on retail marijuana sales, from which the revenue will be allocated to public health and education; (2) allows adults twenty-one years of age and older to possess and to privately consume and grow limited amounts of marijuana; (3) creates a system in which licensed businesses can produce and sell marijuana; (4) establishes a Department of Marijuana Licenses and Control to regulate the cultivation, manufacturing, testing, transportation, and sale of marijuana; and (5) provides local governments with the authority to regulate and limit marijuana businesses.[5] |

” |

Nevada

|

Florida

Ballot title

The title is as follows:[9][10]

| “ | Use of Marijuana for Debilitating Medical Conditions[11] | ” |

Ballot summary

The ballot summary is as follows:[9][10]

| “ | Allows medical use of marijuana for individuals with debilitating medical conditions as determined by a licensed Florida physician. Allows caregivers to assist patients’ medical use of marijuana. The Department of Health shall register and regulate centers that produce and distribute marijuana for medical purposes and shall issue identification cards to patients and caregivers. Applies only to Florida law. Does not immunize violations of federal law or any non-medical use, possession or production of marijuana.[11] | ” |

Financial impact statement

The financial impact statement for Amendment 2 is as follows:[10]

| “ |

Increased costs from this amendment to state and local governments cannot be determined. There will be additional regulatory costs and enforcement activities associated with the production, sale, use and possession of medical marijuana. Fees may offset some of the regulatory costs. Sales tax will likely apply to most purchases, resulting in a substantial increase in state and local government revenues that cannot be determined precisely. The impact on property tax revenues cannot be determined.[11] |

” |

OTHER ARTICLES YOU MAY ENJOY...

GET READY TO VOTE, FIND OUT HOW AND WHEN, CLICK HERE...

OR...

WHO SMOKES MORE CANNABIS THAN YOU, CHECK THE MAP, CLICK HERE..